The World’s Fastest Growing Game

Original Article: Medium, by John Kosner and J Moses, January 1st, 2021

Both of us are big NFL fans and fathers of 13-year-old boys. But on Sunday, when we watch our favorite teams – the Steelers and the Giants – play on CBS and Fox respectively, our boys will be in their bedrooms with mobile devices on their laps, connected to friends and playing Minecraft, Fortnite or TikTok while they track the NFL scores in real time on a gamecast app.

Yes, playing TikTok. It is the fastest growing game in the world, and our boys are part of an entire generation expecting game mechanics to power their preferred entertainment.

Considered by many the mobile YouTube, TikTok is the most intriguing and fastest growing media property in the world. Because, it was designed to be something else. TikTok is built on game mechanics. It is a game featuring content (which can be any content, far broader than just funny dance videos). TikTok rewards people for posting popular videos and watching them; in fact, it tells you how to do it. And it’s all easy. On TikTok, your video’s views are points. TikTok’ers are rewarded with TikTok’s they love. Users create their own individualized experience. It is addictive.

Also, it is not social media as we have traditionally defined it. Instead, it fits on a continuum as our social interactions become more digital and spread over more platforms especially messaging. TikTok is not centered on your friends, but rather Chinese parent company ByteDance’s nonpareil algorithm.

As Ben Thompson points out in his newsletter, Stratechery:

“The chances of your typical Facebook user having a network full of accomplished videographers is slim, and remember, when it comes to showing user-generated content, Facebook is constrained by who your friends are …

ByteDance’s 2016 launch of Douyin – the Chinese version of TikTok – revealed another, even more important benefit to relying purely on the algorithm: by expanding the library of available video from those made by your network to any video made by anyone on the service [emphasis: ours], Douyin/TikTok leverages the sheer scale of user-generated content to generate far more compelling content than professionals could ever generate, and relies on its algorithms to ensure that users are only seeing the cream of the crop.”

Now, it is true that you can follow celebrities and brands on Instagram, and the quality of their posts is often of higher quality. Nonetheless, TikTok is designed to give you the most compelling video at any given time. Turner Novak of early stage VC firm Gelt notes, “on TikTik, the best videos could instantly reach the entire user base.”

Last summer in Bloomberg Opinion, Tim Culpan described TikTok’s touted algorithm as its “secret sauce,” the mobile version of the “Colonel’s 11 secret herbs and spices.” But it’s more than that. Developed as well with ByteDance’s massively popular Chinese news site Toutiao, the TikTok algorithm generates personalization at unmatched scale. Per Novak: TikTok’s “hyper-personalized algorithm recommends content based on thousands of objects and tags analyzed in each individual video, along with an individual’s view history, re-watches, likes, comments, shares, and even post-view activity.”

That’s the very basis of connected game play too – whether it be Candy Crush or Fortnite – an algorithm. Like the leading games, TikTok is not static. Every single user has a unique experience every time and every keystroke builds the TikTok algorithm. Minecraft, Fortnite and Roblox (and World of Warcraft Online for that matter) are each closed platforms – they give players the tools to tailor how they want to play. By following the videographers they like most, TikTok gives viewers that same degree of customization. Dynamic, constantly adjusting to new preferences and signals (such as our sons in their bedrooms connected with their friends), TikTok has produced mesmerizing effects in the U.S. and around the world.

The game has changed the game.

Compare TikTok to Quibi:

Both started in the U.S. in 2018;

TikTok has game mechanics. A bottoms-up approach built around a constantly expanding and dynamically curated user generated content selection;

Quibi was the traditional, time-honored Hollywood media model. Top down. Expensive, professionally produced, high quality content with stars on both sides of the camera. No game mechanics.

Today: TikTok’s market cap is $60B (Parent ByteDance’s is 180B). Quibi is defunct.

Consider JuJu Smith-Schuster, the Steelers’ outstanding wide receiver and, perhaps, the most accomplished gamer and social media performer in sports. Last month, Smith-Schuster found himself under fire because of his viral videos showing him dancing on the logos of Pittsburgh’s opponents. As the Steelers lost three straight after an 11-0 start, he was accused, among other things, of having more posted TikToks than yards per game this season. JuJu says he’s done with the dances (at least for now) but he and other star athletes recognize the power of TikTok. The game has changed the games.

No doubt aided by its data collection and algorithm, TikTok management has also proven to be a quick study of the game business by identifying its audience, giving them what they want, and monetizing it:

TikTok built out its audience – by knowing where to buy it. Earlier this year, TikTok was Snap’s biggest advertiser. It’s the top brand to run app install ads on Snapchat after having been the top app installer on Facebook in early 2019. Per the Financial Times, TikTok has reached 1B users much faster than any other social media app;

In the same way that another fast-growing digital media company, Twitch (Amazon) has broadened beyond its gamer roots into several other content categories plus “Just Chatting” and “IRL” (“in real life”) channels, TikTok has evolved from silly dance videos. Per Tiffany Zhong of Zebra IQ, a Gen Z research company, TikTok is the biggest producer of short-form online video education (on a multitude of topics). And critically for a young, impatient audience, she says, “its videos are no longer than they have to be.” If a TikTok can tell a story in 21 seconds, it does so. Novak: “Short-form video reduces the friction of both creation and consumption. Most TikTok videos are produced by the creator alone, and many post multiple videos per day”;

While many linear TV networks rue not taking a financial position in the licensing businesses of the young, unknown talent they helped popularize (many of whom are now more popular than their sponsor networks), TikTok has been quick to launch its Tiktok Creator Marketplace (TCM). How big will this become? Two weeks ago, Walmart hosted the first-ever shoppable livestream on TikTok. That Walmart was aggressively pursuing TikTok as an owner last summer tells you everything about the audience.

If you are a media company without the benefit of Bytedance’s visionary engineers and world-changing algorithm, what to do?

Make TikTok’s approach a central strategy, not an “extension” of what you do.

Collect data and use it: When we watch the NFL games on Sunday, neither CBS nor Fox will get any data; their revenue is limited to retransmission consent and TV sponsorship advertising. That’s a problem. Creating systems, hiring data-focused executives (many of whom are young) moves companies to a place where they are using data to make decisions. Once you start you never turn back

Give the audience what they want: Sports leagues and other content companies should be more aggressive in allowing these connected audiences on TikTok to follow games in progress, including by putting real-time highlights onto the platform. Otherwise, its audience might not know the games are even happening! Content discovery is a growing challenge; you need to be where your audience is;

Monetize the audience: On Christmas Day, millions of people around the world watched Pixar’s “Soul” on Disney+. Disney has used informed research and data about its addressable audience to establish itself as a retail streaming channel. Now, its actual usage is powering how the service moves forward. Disney+ has also levitated the company’s stock.

Perhaps most important, media companies must heed what makes gaming such a compelling format: we each have our own customized experience, every time is different, and we and our friends are active participants.

John Kosner is President of Kosner Media (www.kosnermedia.com), a digital and media consultancy, and an investor and advisor in sports tech startups. He was the senior digital executive at ESPN for 20 years. J Moses has been in and around the Sports, Games, and Tech businesses for over 40 years. He has been a Director at T2 since 2007, and is currently an Executive Producer on a scripted Esports show for the CW (www.optinstudios.com). Both John and J are disciples of the legendary Roone Arledge of ABC Sports.

Marvel’s Avengers Lend Home to Kosner and Calemzuk for $250 Million SPAC Buildout

Original Article: Sportico, by Eben Novy-Williams, December 24th, 2020

Longtime media executives John Kosner and Emiliano Calemzuk are part of a group aiming to raise $250 million for a special purpose acquisition company.

The group’s filing says 890 5th Avenue Partners will look to invest in an area specific to the expertise of its management team, which includes veterans in media, technology and telecommunications. It specifically mentions sports media, sports betting, esports and fitness platforms as potential targets. The address is a reference to the fictional Avengers Mansion, where many of Stan Lee’s comic book characters lived.

“There are several market verticals we have identified which are undergoing unprecedented levels of disruption in an extraordinarily accelerated timeframe due to a variety of trends, making them attractive pools for business combination candidates,” the group said in a filing.

Those trends include the growing amount of time consumers spend on new platforms, the rush to create and distribute content at a faster rate and the myriad ways digital technology is upending social media, interactive entertainment, gaming and education. Earlier this month Kosner co-authored a Sportico op-ed that hit on some of these same themes.

The group’s filing says it is targeting companies with an enterprise value between $750 million and $2 billion. It says it doesn’t have a specific target, nor has it had any substantive discussion about any specific acquisitions.

This is the latest sports-adjacent SPAC to reveal its intentions to raise money and pursue an acquisition, a phenomenon that Sportico has tracked all year (click here for our SPAC Primer). There are at least 40 SPACs that are sports focused or led by sports executives, and collectively, they’ve raised or seek to raise over $16 billion in total capital.

The group’s executive chairman is Adam Rothstein, co-founder of Disruptive Technology Partners and Disruptive Growth, a pair of Israeli investment funds focused on technology. He is also a sponsor of Roth CH Acquisition I Co., a SPAC in the process of acquiring plastics recycling company PureCycle Technologies. Rothstein declined to comment.

Kosner led ESPN’s digital media from 2003 to 2017. After leaving ESPN he and NBA commissioner emeritus David Stern launched Micromanagement Ventures to invest in sports and technology start-ups. Kosner also runs his consultancy, Kosner Media.

Calemzuk, who will be the group’s CEO, spent 14 years at 21st Century Fox/News Corp, including leadership of the group’s scripted and non-scripted television shows and as president of the Fox Television Studios. Since leaving the company in 2012, he’s helped Time Inc. build its digital video strategy, participated in a $400 million SPAC led by Jeff Sagansky and Harry Sloan–the two investors who later took DraftKings public–and is currently an executive at ecommerce and payments platform MercadoLibre.

John Kosner on Sports Podcasts with Sportico’s John Wall Street

Original Article: Sportico, by John Wall Street, December 16th, 2020

SPORTS PODCASTING GENERATES INVESTOR INTEREST WHILE TURNING TO MONETIZATION QUESTIONS

Yesterday, Axios reported that Blue Wire, a sports podcasting network, had raised $5 million in Series A funding (the company did not respond to a request for insight on the valuation). The investment round, led by Dot Capital (Bettor Capital, Side Door Ventures and Forty5 Ventures also participated), comes just 10 months after Blue Wire announced it had closed on $1.2 million in seed money (that round was also led by Dot Capital).

Over the last twelve months, venture capital has been steadily flowing into the sports audio ecosystem (see: Spotify’s $196 million acquisition of The Ringer). But “there is much more attention [being paid by investors to the sports podcasting space] than there are revenues [being] generated against it,” cautioned Kosner Media president John Kosner, who wondered how investors plan to achieve a return on their investments. “There’s too much supply and too few buyers. [The space] feels overcrowded at the moment and other than Spotify, there aren’t any real confirmed [acquirers].” In addition to Blue Wire, Barstool Sports, The Ringer, ESPN, The Athletic and Sports Illustrated are all producing sports podcasts.

Our Take: Blue Wire is working to become the go-to platform for athletes (A Touch More with Megan Rapinoe & Sue Bird), teams (the Baltimore Ravens’ Black in the NFL) and sports media talent with a following (Haley O’Shaughnessy, formerly of The Ringer) to host and monetize their audio content. Its network currently includes 140 topical and regional podcasts designed for the next generation of sports fans. “We’re making a bet that the future is individual shows about individual teams a few times a week, not three hours [each day] of some 60-year old radio buffoon yelling about stuff they don’t even know about,” said Blue Wire CEO Kevin Jones.

As someone who started his career in sports radio—a notoriously underfunded business—it’s exciting to see so much investor enthusiasm for “sports radio 2.0” (as Jones called sports podcasting). But Kosner suggested the current boom is less about the demand for hyper-local sports programming and more about the greater technological shift occurring.

“You have this explosion of audio content [including podcasts, books, news articles, apps like Clubhouse] all being driven by the mass adoption of Apple’s AirPods and smart speakers from the likes of Amazon, Google and Apple,” he said.

For perspective: In 2019, Apple generated more revenue in AirPod sales than Twitter and Snapchat took in, combined.

While historically there hasn’t been much money within the sports radio business (at least relative to other media channels), Kosner believes that has more to do with the medium “never really being viewed as a premium buy compared to TV and the internet” than a lack of advertiser interest in the listener demographics. “There could be money made in sports podcasting if a new personalized, targeted advertising [market] were to take hold,” he said (think: what Facebook and Google do for mobile ads).

But Bettor Capital founder (and former Barstool Sports head of strategy & corporate development) David VanEgmond “fundamentally disagrees” an ad marketplace is needed for podcasting businesses to achieve meaningful revenues. “If you listen to [Barstool’s Pardon My Take, which is among Apple’s top podcasts], there is not one programmatic ad read,” he said. “It’s all organic. It’s all integrated. It’s all about execution. If [a podcast] can deliver for sponsors and make advertising feel a part of content as opposed to a break, then there is a strong ability to monetize.”

It should be noted that the average Blue Wire podcast listener listens for 45 minutes at a time. “The completion ratio for podcasting is really impressive,” Jones said, “and brands are starting to recognize it.”

VanEgmond acknowledged that the balance of Kosner’s concerns about the industry were valid, but he remains excited about the long-term opportunity sports audio presents.

““Podcasting as a medium is seeing significant growth in advertising dollars. I believe advertising in and around sports will continue to increase. [Blue Wire] has the infrastructure in place to go from 140 podcasts to thousands of podcasts. When you add up the collective scale, this is a business that can generate material advertising revenue. The backdrop of monetization here is very good.””

Kosner acknowledged that if the company develops a strong network of local market team podcasts it would be “a logical acquisition target for somebody—no question.”

Given its focus on local and regionalized content, VanEgmond called sports betting a “huge opportunity” for Blue Wire and the balance of the sports podcast business. “[Blue Wire has] two very strong Detroit Lions podcasts,” he said. “So when the Michigan market opens for sports betting, to think they would be very valuable assets for [sports betting operators within the state] is probably right.” Remember, sports-talk radio and sports podcasts have proven to be effective channels to market a sports betting product, and operators are only going to be spending more money. Added VanEgmond: “FanDuel and Draftkings spent [in the range] of $200 million each in the second half of this year, and fierce competition is beginning with BetMGM and other competitors beginning to grow their spend substantially as more states turn on.”

Monetizing the podcast network via advertising may be the lowest hanging fruit, even if podcast advertising remains in its nascent stages. But Jones sees the greatest upside for the business as developing original series—the plan is to do 8 to 10 a year—and the prospect of turning the storytelling into feature films, as Wondery has done: “Our bet is people are going to read less and listen to stories more over the next decade, and we’re going to build some of the best ones.”

John Kosner is quoted regarding the SEC’s decision to leave CBS for ESPN

Original Article: Alabama.com, by John Talty, December 10th, 2020

After being announced as the next Southeastern Conference commissioner in March 2015, Greg Sankey immediately started thinking about his conference’s next media rights deal.

ESPN had the majority of the SEC’s rights locked up through 2034, but the fate of the SEC on CBS package, considered the crown jewel of college football, had long been a source of intense speculation within the sports TV industry. For years, CBS benefited from one of the sweetest deals in sports TV, paying a mere $55 million annually to get the SEC’s weekly top game plus the SEC Championship.

After losing long-trusted TV advisor Chuck Gerber, who passed away that same year, Sankey opted to take his time and do his due diligence. In 2018, the SEC hired Evolution Media’s Alan Gold and CAA’s Nick Khan to guide the conference through the future media landscape. He consulted trusted deputies Charlie Hussey and Mark Womack as the senior SEC leadership weighed all of their options.

After years of consideration, Sankey and the SEC came to the conclusion it was time to go all-in with ESPN.

In a deal announced Thursday, though agreed to nearly a year ago, the premier package in college sports is leaving CBS for ESPN starting in 2024-25. Exact terms of the 10-year deal were not released though sources told AL.com the agreement is for upwards of $300 million annually, a massive increase from CBS’ price.

A key component of the deal will be a weekly SEC game on ABC, giving the league a much-desired broadcast platform once it leaves CBS. That will include a regular late afternoon kick like the SEC on CBS time slot but also the ability to feature the games in primetime for ABC’s Saturday Night Football. The strategy will be to “put the biggest games in the biggest places in front of the most people,” Burke Magnus, ESPN’s executive vice president of programming and scheduling, told AL.com in an interview.

RELATED: Winners and losers of SEC football leaving CBS

Magnus and his ESPN colleagues eyed the top SEC game package for years, waiting for their chance to pitch their plan to the SEC. Sources told AL.com last year landing the entire SEC inventory had long been a major priority for the company. Magnus had buy-in and support from his boss, ESPN president Jimmy Pitaro, and the big boss, former Disney CEO Bob Iger, to pursue a deal. When the conference indicated in 2019 it was ready to have that discussion, Magnus said, “We were ready when the phone call came.”

Beyond the massive cash component, a big selling point was the scheduling flexibility that would come with the SEC only having one scheduling partner. Magnus described it as a “one plus one equals three dynamic” where having every football game helped ESPN offer better distribution and exposure that no other entity could offer the SEC. One expected benefit is the league could schedule game times much further in advance without having to wait on CBS’ game of the week pick.

The opportunity to maintain a traditional broadcast spot plus the flexibility that comes with ESPN, the SEC Network and ESPN+ was too good for the SEC to pass up. Starting next year, ESPN+ can also air one non-conference game per school and up to two non-conference basketball games.

“All of those were important elements of this conversation and led us down the path to decide that the affiliation with the Disney brand, with ABC and ESPN, was going to be the right opportunity for our future,” Sankey told AL.com.

One of the looming questions over the deal will be if it will take until 2024 to go into effect. After ESPN closed in on acquiring the SEC rights last year, there was considerable industry speculation that it would also try to buy out CBS early from its contract with the SEC. According to sources, that desire hasn’t gone away, but no high-level discussions have taken place to this point. Magnus didn’t deny there was interest, though he pointed out it was “entirely outside of our control.”

“We’re not anticipating necessarily, but this partnership is so important to us that if there was an opportunity to discuss something in that regard, we’re open to that conversation,” Magnus said. “But only if it’s a positive development for all the parties.”

Sankey added, “CBS obviously continues to be an important relationship for the SEC and has been for many years, and even in this odd year of 2020, that remains. Our focus has been on the three years remaining in our agreements...and that’s really how we’ve looked at the situation, both at present and as we go forward.”

Once the deal goes into effect, it’ll be a significant financial boon for all 14 SEC schools. The SEC schools, which received more than $45 million last fiscal year, will receive at least an additional $15 million from this new deal alone. For ESPN, it will finally get the chance to televise every game it wants, from the Iron Bowl to Florida-Georgia, that CBS had picked for itself for the last two-plus decades.

“I think increasingly the media business is about must-have content,” John Kosner, president of Kosner Media and a former ESPN executive, told AL.com. “Not just having a lot of stuff, but having the stuff everyone wants to watch. The SEC games every week that CBS had are examples.”

John Talty is the sports editor and SEC Insider for Alabama Media Group. You can follow him on Twitter @JTalty.

John Kosner is quoted in SBJ profile of Bit Fry Founder & CEO Ben Freidlin

Original Article: Sports Business Journal, by Eric Prisbell, December 7th, 2020

The company’s first game brings athletes from multiple sports together on The Rink. Photo: Courtesy of Bit Fry Game Studios S even years ago, Ben Freidlin set about making an improbable vision a reality: trying to create an unlicensed baseball video game set in the 1920s…

Sports Will Rise Again in 2021 - If There’s Change

Original Article: Sportico, by Ed Desser & John Kosner, December 1st, 2020

The Netflix documentary, The Social Dilemma, demonstrates how social media has profited exponentially by aligning the population at different extremes—utilizing content we ourselves create online to divide us further. Pre-COVID-19, these divisive efforts had considerable momentum; the virus has only accelerated them.

If ever there were a moment that our country (in fact, the world) needed the unifying power of sports, it’s right now. Every month we spend in isolation turns us inward and reinforces the thought that engaging with the people around us is dangerous. Sports can help us not only overcome the anxiety of gathering in a group but also return us to the interactions that help us heal and grow together as a society. But sports has never faced the obstacles it does now. The industry must get to work.

When we grew up, following our local team was practically a shared civic duty. Kids and adults alike engaged in highly topical “water cooler” discussions. It was an era of media (bandwidth) scarcity; we watched and listened to the games, read about them in the newspaper (remember those?), saw highlights on the 11 p.m. local news, discussed them at meals and as a shared family experience on our living room couches. Very little of that “shared world” experience still exists today. Instead, everyone carries an entertainment ecosystem in their pocket.

And yet, in 2020, nothing unifies Pittsburgh like the undefeated Steelers. Even when, because of COVID, we can’t gather together as much as we long to.

That said, sports needs to update its user experience dramatically. As leaders, we must:

Reinvigorate sports’ place in the community. Tod Leiweke, one of the sports industry’s most accomplished executives, has made an impact in multiple leagues across North America, and the former Seahawks CEO is now back in Seattle with the NHL expansion Kraken. Back in 2010, when he was with the then-struggling Tampa Bay Lightning, Leiweke, his colleagues and team owner Jeff Vinik created a program that honored a local hero every game during the first timeout in the first period, including a $50,000 donation supporting the hero’s work. The Vinik family stepped up, providing $10 million in funding for the program, double what the staff originally requested. The program bound Tampa and the Lightning and is a powerful example of why our former boss, ex-NBA Commissioner David Stern, championed sports and community service—“doing well by doing good.” We need much more of this going forward.

Prioritize getting young fans back into our stadiums and arenas. Rich Luker, founder of the original ESPN Sports Poll (now the Luker on Trends Poll), makes the point that if children attend a major or minor league baseball game prior to age 5, they will go to 58% more games per year, for the rest of their lives,than fans who do not attend their first game until age 14. He says the same logic applies to the other major leagues. Waiting is not an option. The Sports Poll 2020 is replete with examples of how our youngest fans, ages 12 to 17, spend their time not involved with sports. In its IPO S-1, the startup Roblox, essentially a YouTube for Gaming, lists not only more daily active users (31 million) than any sports site but also a uniquely engaged audience (averaging a stunning 2.67 hours daily on their platform).

Revolutionize viewing of live game telecasts. Live events have traditionally commanded unmatched attention and escalating rights fees. They are the life blood of the industry. But, per the Sports Poll, live game viewing is no longer a priority for fans 12 to 34—simply unthinkable a generation ago. In fact, for the first time, sports is struggling to maintain relevance among young fans. Media companies and rightsholders must attack that directly. Using modern platforms like YouTubeTV, fuboTV and Twitch as examples, sports needs to embrace choice (announcers, themed feeds, packaging outside of the pay TV bundles, communal viewing, shorter formats) and make itself available on multiple devices. Sports should lead in innovation for large screen TV viewing (the recent quad screen viewing from the Masters on its own and the ESPN app is a recent example). Betting is a tactic here to lure adult fans,but not the all-in winning strategy to incubate grassroots fandom.

Bring sports to where its new fans are. Essentially, sports must drastically improve availability and ease of discovery. Before, just being on the right TV network was sufficient: Sports event audiences were funneled to the next live event via inertia. Among other things, access today to live games needs to be a click away or, in the case of Snap and others, a swipe up. This fall, Snap is running a trade campaign for advertisers: “Millions of NBA fans are on Snapchat every day.” These NBA fans must be able to access NBA games there, too. Discovery should extend broadly: Fans should be able to find out about live games and be able to watch and participate with them via links from Twitch, the various social media networks, Apple and Amazon, but also game “metaverses” like Fortnite and Roblox. And thinking more broadly, Zoom and Discord, too. Wherever fans are. Today, top players have more social media followers than their leagues do; these athletes too must step up and promote links to live games from their social handles. “Rent” (user acquisition) costs and performance marketing strategies will rise to the fore. A new startup called Buzzer is an early example of a service tackling the issue. Naturally this will require rethinking and readjusting business models, so expect change to be slower than optimal from the new audience’s standpoint.

According to the Sports Poll, as recently as 2007, fans got their sports information from three leading sources—online, TV and newspapers, each with about a 25% share. Today, online has accelerated to 69%; TV has shrunk to 17%, and newspapers have practically disappeared (5%). In 2011, men 18 to 34 occasionally went to Google for sports information (5%); today, it’s their most used sports news utility (23%). Fans move to the best experience available, and quickly. Sports needs similar urgency across the board.

The new presidential administration offers true opportunity. President-elect Biden can push sports to unify a fractured country. Biden has promised an organized national response to COVID-19 and will oversee the rollout of the first vaccines. This will speed the reopening of outdoor and, potentially, indoor venues. The leading sports leagues are national operations and need streamlined practical solutions to operate universally across state lines and welcome back fans. Some U.S. venues have hosted numerous events, under structured conditions, with no indication of virus spread. A nationally coordinated effort to apply lessons learned from successful events would inform reopening discussions at local health departments around the country. Perhaps some of the lessons could improve the safety of all indoor public spaces.

In 1963, President Kennedy established the President’s Council on Physical Fitness. Wouldn’t it be powerful if Biden created a President’s Council on Community Gathering, centered around sports, with the sports industry taking the lead?

Over the past 50 years, changes in the environment have almost completely benefited sports and fueled their growth. No longer. Whether it’s the mere act of gathering together, how we watch the games from home, or the manner in which we get news about our favorite teams and athletes, it’s now changed utterly. The internet-led disruption of myriad other industries has finally hit sports. We must respond now.

Ed Desser is president of Desser Media, Inc. (www.desser.tv), a sports media consultancy. He was the senior media executive at the NBA for 23 years. John Kosner is president of Kosner Media (www.kosnermedia.com), a digital and media consultancy and an investor and advisor in sports tech startups. He was the senior digital executive at ESPN for 20 years. Together they ran NBA Broadcasting in the ’80s and ’90s.

John Kosner joined Howard Lindzon for “Investing in Profit and Joy”

Original Article: Investing in Profit and Joy, by Bullish, November 10th, 2020

Listen in as Howard Lindzon and John Kosner discuss investing in sports, fitness, media, and technology!

The COVID-19 Halftime Report

Original Article: Sports Business Journal, by John Kosner and Ed Desser, October 26th, 2020

Sports will contiue to be larger than life as we navigate our way through 2020 and beyond. The Sports Glut hit this summer, but as we await COVID-19’s “Second (Sports) Wave,” we have reached one marjor conclusion: We predict more sports industry change will occur in this decade than in the previous five combined. Keep reading.

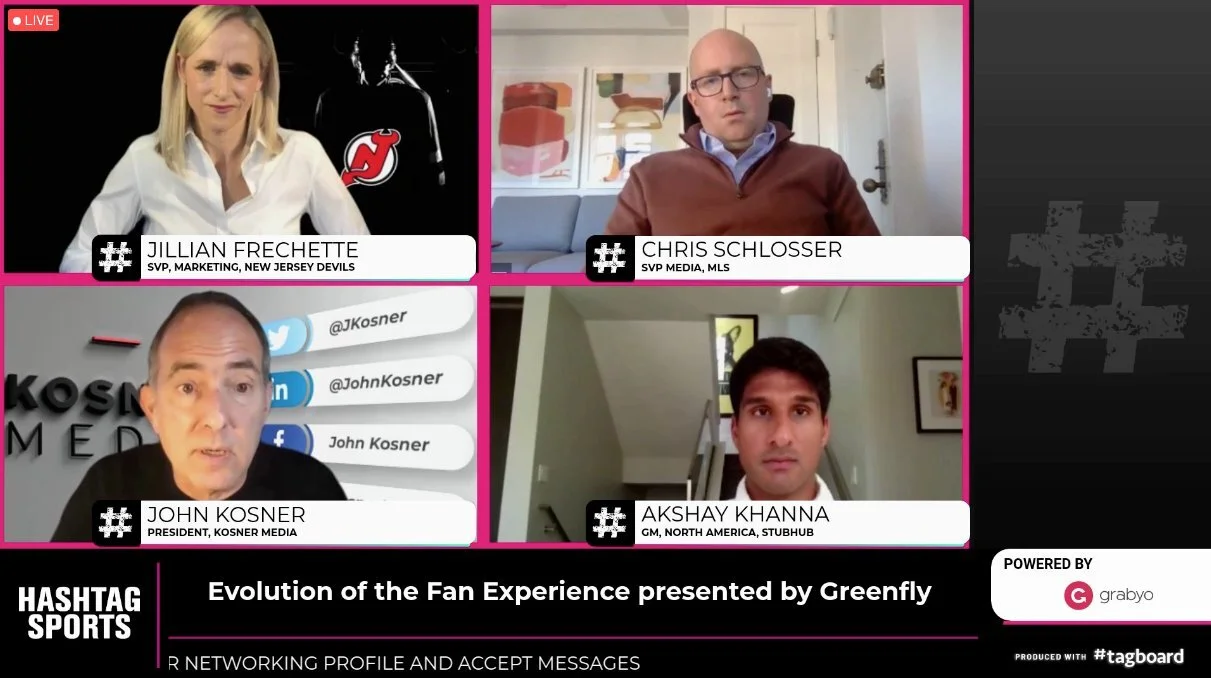

John Kosner Moderated the "New Normal Meets New Generation" Panel for Hashtag Sports

Original Article: Hashtag Sports 2020, October 20th-22nd, 2020

Building off the huge success of Hashtag Sports LIVE in June 2020, the Hashtag Sports 2020 virtual conference featured video conference-enabled facilitated meetings that are fueled by AI-driven matchmaking, enabling individuals across the sports, media & entertainment landscape to connect with one another at unparalleled scale in distributed and digitally interactive environments.

Hashtag Sports 2020 provides unrivaled & interactive access to the industry's brightest minds, forward-looking executives, and athletes & creators, bringing together the most influential names and next generation of talent in digital sports & entertainment media for creative exchange, inspiring talks, and actionable insights. Learn from fan engagement's leading experts how COVID-19 and brand purpose will continue to change day jobs moving forward while staying ahead of the latest trends in content creation, media, and monetization.

John Kosner Quoted About Sports Betting Integration on TV Broadcasts

Original Article: Front Office Sports, by Michael McCarthy, October 19th, 2020

The NBA doesn’t know yet when it will tip off its next season. But one thing is certain: TV networks and media companies will increasingly experiment with more “alternate” game telecasts focused on sports betting.

During the 2019-20 season, the league teamed with TNT, Bleacher Report, The Action Network, and Yahoo Sports to experiment with live game telecasts or streams that featured expert gambling analysis, betting lines, and discussion of the odds.

During TNT’s coverage of the NBA Western Conference Finals, the network offered betting-minded viewers an alternate livestream feed called “TNT Bets.” It was hosted by B/R’s Cabbie Richards, Kelly Stewart, and Tim Doyle. The sports betting-focused feed was available to cable and satellite subscribers through the Watch TNT website.

Meanwhile, NBA Digital offered fans a dozen “NBA BetStream” telecasts this August via NBA TV and NBA League Pass. Presenting partner BetMGM provided real-time betting lines and stats. Even if consumers didn’t have access to NBA TV through their cable providers, they were able to buy BetStream through a direct-to-consumer subscription on NBA.com.

Chad Millman, the chief content officer at The Action Network, said these alternate telecasts are “exactly” what leagues and TV networks should be testing as sports TV audiences continue to fragment.

“They should be thinking about alternative broadcasts. They should be thinking about hyper-focusing on very engaged audiences,” said the former ESPN executive. “It’s only going to be more relevant — regardless of the pandemic situation.”

Scott Kaufman-Ross, the NBA’s head of fantasy and gaming, said he wants to create a more integrated experience for fans interested in live, in-game wagering.

“We view these telecasts as a great way to engage on a deeper level with our fans who are watching the game through a sports betting lens. This was a beta test. We wanted to learn from it,” said Kaufman-Ross about the BetStream games.

“We also worked with different influencers across Bleacher Report, The Action Network, and Yahoo Sports to experiment with different approaches and different expertise to learn what works best,” he added. “That will help our strategy as we go forward.”

Other networks have previously tested gambling-driven telecasts. NBC Sports Philadelphia experimented with a 10-game “BetCast” slate of Philadelphia 76ers games during the early stages of the 2019-20 season.

Even if they’re not doing it yet, most networks believe sports betting will be an important part of their future programming mix, according to John Kosner, president of Kosner Media.

“You will certainly see the acceleration of second screen and second channel integration with betting information because there’s a point of view that it’s coming — and that’s what fans want.”

“You will certainly see the acceleration of second screen and second channel integration with betting information because there’s a point of view that it’s coming — and that’s what fans want,” Kosner said.

The COVID-19 pandemic is not over. As more U.S. states legalize mobile betting, and the weather turns colder, sports betting is poised to “accelerate” among locked-down consumers this fall, predicted Kaufman-Ross.

Especially if the state of New York — which has over 19 million residents — finally legalizes mobile betting, instead of forcing gamblers to travel across the Hudson River to neighboring New Jersey.

“We feel a lot of our fans are consuming NBA content through the lens of sports betting. So we want to make sure to engage our fans where they are,” he said.

“We’ve often said we see sports betting as more of a pull than a push,” he added. “So if fans want sports betting content, we want to give it to them. If they don’t, it’s not necessarily something we’ll force on them. We think an alternate telecast is a great example of how we can accomplish that.”

The NBA’s alternate media partners are waiting to hear when the next season will tip-off, with recent comments pointing to a January-March 2021 start time. Once that decision is made, they’re ready to roll with more alternate sports betting telecasts.

The Action Network’s BetStream experience “went really well,” Millman said. He’s looking forward to serving some of the NBA’s most rabid fans next season.

“If you’re betting on the NBA, you are watching the NBA. You know every player. You’re betting not just on totals but on quarters and halves and player props,” he said.

“There are literally dozens of markets that the folks who are watching these games are betting on,” Millman added. “It just brings a different level of drama and insight.”

A spokesman for B/R confirmed the media outfit is interested in working on more TNT Bets projects next season. “It is definitely a path we are pursuing for the future,” he said.

John Kosner Appeared on The Forbes School of Business & Technology Panel

Original Article: Forbes Thought Leader Summit, October 20th, 2020

John joined Amy Brooks from the NBA, David Katz from Fox Sports Digital, former Hulu chief Randy Freer, his colleague Ed Desser, Chris Dempsey from Altitude Sports, and Leonard Armato for the Forbes SBT event on October 20th, 2020. Watch the recap below.

John Kosner 1-on-1 with David Levy

Original Article: The Future of Sport at Advertising Week, by Global VC Sports, October 8th, 2020

GlobalVC Sports partnered with Advertising Week to present the 7th Annual “Future of Sport.” Advertising Week granted free access to the entire week, which featured 750+ Speakers and 350+ Virtual Events, including John Kosner’s 1-on-1 with David Levy.

John Kosner Appeared on a Sports AI Panel for SportsProLive on Sept. 16

Original Article: SportsProLive, September 16th, 2020

Driving the new era of sports

Leading experts across the sports ecosystem will gather to discuss the most disruptive and challenging topics facing the industry today.

Attendees will hear from and connect with the most innovative brands, rights holders and technologies from all corners of the globe.

Founded on six key pillars – everything from AI to data to sustainability to digital transformation will be tackled head-on by the event’s pioneering speakers and thought leaders.

Watch the video recording below!

John Kosner Appeared on Two Panels for SIGA Sport Integrity Week

Wednesday, September 9th: “ESPORTS: THE FUTURE, NOW!”

Thursday, September 10th: “SPORT INTEGRITY, TECHNOLOGY & INNOVATION: THE NEXT BIG THING”

For more information on the Sports Integrity Global Alliance, visit their website.

John Kosner Talks to Ben Fischer at the SBJ About the Risks if the NFL Can’t Play

Original Article: Sports Business Journal, by Ben Fischer, August 31st, 2020

Every year from September to December, America’s top-selling beer brand turns its entire marketing budget — more than $100 million — toward the NFL: Tens of millions of team-logoed Bud Light cans, retail displays, sweepstakes, national television advertisements, the works.

This year is no different, and most of that is already on its way to market. It’s a typically routine step that has taken on the feeling of risk for Anheuser-Busch InBev during the pandemic.

“If for any reason the NFL season doesn’t happen, it really pulls the rug out from under us, and quickly,” said Nick Kelly, vice president of partnerships, beer culture and community at AB InBev. “The hard costs associated with basically taking all the creative — that we put months into developing from retail to TV — and quickly running to create something else are astronomical.”

Such is life for anyone with a vested interest in the success of the NFL in 2020. The last American sports league to attempt a season during the global pandemic is also the most dominant one, raising the stakes for a sport that always carries a heavy responsibility for the entire industry in television ratings, sponsorship activation and other business imperatives. Bolstered by low COVID-19 case counts in training camp, confidence remains high at the league’s Park Avenue headquarters that the Super Bowl champion Kansas City Chiefs and star quarterback Patrick Mahomes will kick off the season Sept. 10 as planned and that the schedule will be played to completion. But there can be no promises that major disruptions can be avoided while the virus is snaking across the country untamed.

The NFL and NFLPA have adopted new operattional guidelines designed to minimize the risk. But in many key ways, this season will look very much like the ones that have come before it. No bubbles protecting players. Large rosters. Coast-to-coast travel. And all for a sport that requires frequent physical contact.

While other sports have made dramatic adjustments to their playing rules, their schedules or both, the NFL has done little of either, even while knowing positive test cases are almost inevitable. Yet because no other sports property comes close to generating the economic and social impact the NFL does, a remarkably wide range of business partners are counting on the league to complete this season’s high-wire act relatively unscathed.

“The NFL is the bell cow of the sports industry, that’s the cow that leads the rest,” said Marc Ganis, a financial consultant to the league and many NFL owners. “It goes way beyond size. It has to do with interest.”

Media rights holders AT&T, NBC, CBS, Fox and Disney/ESPN would take the immediate brunt of a cancellation, though it would reverberate throughout the sports industry over time.

“The nuclear option is if the NFL can’t play,” said media consultant John Kosner, a former ESPN executive. “I hope we’re wrong, that we never have to contemplate that, but that puts not just the networks into a very difficult place, but there’s collateral damage as far as you can see. Everybody loses in that scenario.”

Last year, the networks sold $5.7 billion worth of ads on NFL games, not including the Super Bowl, according to iSpot.tv data, dollars that networks would find immensely difficult to recover elsewhere with so few shows approaching the live audiences generated by the NFL.

Problems in college football may exacerbate the outsized role played by the NFL. This month, the Big Ten and Pac-12 postponed their fall seasons due to the pandemic, while the ACC, Big 12 and SEC are still planning to play as universities across the country struggle with fall semesters. That’s caused some marketers to shift spending away from college to the NFL, underscoring the market’s comparatively high level of confidence in the league while also raising the stakes further.

A substantial loss of NFL content would cause a revenue gap that goes beyond the sports division at the networks, said Dean Jordan, managing executive of properties at Wasserman.

“Not only do the networks sell advertising for that particular game, but like most tent-pole programming, it’s packaged with other advertising buys that go throughout the year, so the trickle-down effect could be very significant,” Jordan said.

Fox alone brought in $1.87 billion in NFL advertising last year, not including the Super Bowl, with CBS hitting $1.55 billion and NBC around $1.35 billion, according to iSpot.tv data. ESPN’s NFL advertising revenue is far less, around $475 million, but the cost is felt differently inside Disney — the NFL would need to find new topics for many hours of daily NFL analysis and talk shows.

And the problems wouldn’t stop with the money. Of the top 50 shows on television last year as measured by viewership, 41 were NFL games, and the networks depend on that platform to keep pace with rapidly changing consumption habits.

Networks use the NFL as a pathway to audience growth elsewhere, whether it be CBS promoting its traditional network shows on Sunday afternoons or NBC promoting its new streaming service, Peacock. ESPN will do the same with Disney+, and CBS with CBS All Access.

“It’s far more than a math problem,” said Doug Perlman, founder and CEO of Sports Media Advisors and consultant to the NFL, NASCAR, MLB and others. “Part of the reason the NFL is so different is the straightforward financial analysis, but it’s also the strategic importance of the NFL to so many different businesses.”

The biggest immediate threat is to AT&T’s DirecTV, which depends heavily on the NFL Sunday Ticket out-of-market package to drive subscriptions.

“My perception is it’s a huge driver of their customer acquisition and retention,” Perlman said of Sunday Ticket, “and if their consumer base thinks they have to go a season without NFL games, I suspect that would have significant implications.”

Simply put, the NFL is a true mass media, broadcast event in an era when those are hard to find elsewhere. Even minor NFL games draw viewership rarely seen in scripted TV or other sports.

With a Thursday night and Sunday afternoon package, Fox in particular depends on the league — 38% of its entire live network audience in 2019 came from football, according to a MoffettNathanson analysis of Nielsen figures (ESPN is 13%, CBS 12%, and NBC 10%).

Kosner said substantial interruptions to the NFL season could accelerate cord cutting, jeopardizing nonsports cable channels too. “That’s the downstream impact,” he said. “And then we’re talking about sports radio, betting and Las Vegas, and fantasy, and sports bars and restaurants, merchandise, travel and hospitality. It’s mind-boggling, the significance of the NFL to TV and everything that flows off that.”

Sports gambling, one of the most promising new revenue streams of recent years, would also take a big hit. Despite some diversification of bets that’s come with legalization, sports betting is still heavily seasonal. Last December in New Jersey, football (both college and pro) made up 39% of the state’s $571 million handle, while parlays (most likely football-related) comprised another 22%.

The vast majority of gamblers lay action on the gridiron, and then shops like DraftKings try to convert them into year-round customers, said DraftKings CEO Jason Robins.

“I think the last few months have shown that [people will find things to bet on],” Robins said. “But certainly football is a huge driver. There is a substantial base of people — and hopefully this will evolve — but there is a substantial base of people who, all they do is football. So without football there to activate them, it’s going to be harder.”

At the start of the pandemic, the NFL set its sights on a normal season. But gradually, its ambitions have been pared back. First, international games were canceled, undercutting the league’s growth timeline in the U.K. and Mexico. Then all preseason games were canceled, and as of Wednesday, roughly two-thirds of the league will start the season with no fans.

Three particular local markets stand to lose the most from virus disruptions: Los Angeles, where Rams owner Stan Kroenke’s self-financed $5 billion SoFi Stadium will be forced to open with few or no fans and cancel most non-football events, delaying the cash flow needed for debt service; Las Vegas, where the league hopes to transform the Raiders into a gold mine; and Tampa, which is counting on not just hosting Super Bowl LV but on the week of festivals it would have in advance of the game.

Even in stadiums that have obtained permission to sell some tickets, it will be a season of hard knocks. “We’re going to lose millions and millions of dollars,” said Dolphins and Hard Rock Stadium CEO Tom Garfinkel. “We’ll lose a little bit less because we have 13,000 fans [per game].”

The NFL’s accumulated wealth and conservative financial practices put it in a good position to survive the crisis, said Ganis — assuming the season does get played in some fashion. But there’s no denying the devastating impact of so many tickets going unsold.

“There’s going to be a meaninfgul multibillion-dollar loss,” Ganis said. “That’s significant. It’s going to affect every team, every owner, every player. It’s going to affect people from the star quarterback to the people who clean the stadium after the game, from the parking lot attendants to team owner. Everyone is going to get hurt.”

The concessionaire and stadium operations business, too, is preparing for the worst. Companies such as Aramark employ workforces from 800 to 2,000 in the 10 NFL stadiums where they have contracts, said Alison Birdwell, president of Aramark Sports and Entertainment. Already beset by mass cancellations in the concert industry and other sports, concessionaires are now faced with greatly reduced sale volumes under circumstances that will require costly new antivirus procedures.

“Many of our business models are built on capacity and economies of scale,” Birdwell said. “It’s a challenge when you cut it down to 10%-15% of capacity, because our business model doesn’t shrink the same way.”

In reality, it’s not simply a matter of playing or not. There are endless variations on how the virus might disrupt the season, and broadcasters, sponsors and others are trying to be flexible. For instance, Bud Light can adjust to changes in the back half of the season, Kelly said, after the initial run of retail displays and packaging is distributed.

But the worry for the NFL and the sports industry long term, said David Grant, the outgoing MKTG president of sports and entertainment, is that companies will discover new, less risky ways of reaching consumers. To prevent that, Grant said, agencies must work hard to find other ways to activate sponsorships if games are canceled.

Along with Bud Light, 36 other league sponsors and hundreds of team-level sponsors directly use NFL intellectual property to sell, many tying mission-critical holiday sales campaigns around the league. Last year, those deals generated $1.47 billion on those rights, not including the companies’ accompanying promotional campaigns, according to IEG. Even amid the pandemic, the NFL has signed two new ones already, Invisalign and Subway.

“If I’m spending $10 [million] to $20 million in the NFL, and I’m a CEO, and all of a sudden those dollars become available to me, it doesn’t necessarily mean I keep it in the NFL, or keep it in marketing at all,” said Grant, whose agency advises numerous NFL clients on sponsorship strategy and activation. “Those dollars can go anywhere else, including back to the house.”

In general, the media and marketing industry feel confident the NFL will get to the finish line. One particularly rosy set of projections — in which the NFL actually thrives during the pandemic, with ratings growth because of limited competing entertainment options — doesn’t seem entirely out of the question.

But the anxiety around the fall sports season still dents that optimism, if for no other reasons than past experience. When the pandemic first emerged, most industry insiders considered the NFL’s fall season relatively secure compared to the sports disrupted at that time. But after five months of inconsistent and ineffective response by the public and the government, the NFL remains highly vulnerable to pandemic disruptions.

“I think at the time, people thought things would be under control by now, and they’re obviously not,” Perlman said. “But by the same token, leagues have figured out how to successfully play without fans, or limited number of fans, and the NFL certainly has the ability to look at what they’ve done in the other leagues and take the best practices.”

For a league that always seems to land on its feet during a crisis, the luxury of having watched other sports navigate the pandemic is yet another leg up. But for an industry accustomed to total control, one nerve-wracking fact remains: This year, there are no guarantees.

Senior writer Bill King contributed to this report.

John Kosner Spoke to Mike McCarthy at Front Office Sports about the Big Ten and Pac-12 Networks Without Games

Original Article: Front Office Sports by Mike McCarthy, August 28th, 2020

The last decade has seen the rise of conference networks such as Pac-12 Networks and Big Ten Network. These networks have helped enrich their conferences and given die-hard college sports fans another viewing option.

But what happens when these sports cable networks don’t have any live sports to show their viewers? That programming crisis might only get worse as more colleges cancel sports and the pandemic rages with no end in sight.

The Pac-12 Networks, for example, laid off 10 staffers and furloughed another 66 employees Aug. 26, according to Jon Wilner of the Bay Area News Group and author of the Pac-12 Hotline newsletter.

The painful staff reductions came only two weeks after the Pac-12 Conference announced it was postponing all fall and winter sports until Jan. 1, 2021.

The furloughs run for three months, allowing the company to possibly fill dozens of open jobs if competition resumes in 2021.

“They’re banking on [furloughed employees] getting other jobs so they don’t have to pay them their severance on the back end,” said one laid-off employee, who declined to give his name because he’s seeking employment at another network.

Among the cutbacks, Pac-12 Networks eliminated the entire digital team responsible for its website, app, and social platforms, wrote John Canzano of The Oregonian. The result is a TV/digital network that appears to be on hiatus. Why would anybody watch, or advertise, on a network, he asked, that appears to be waving the white flag of surrender?

“From my standpoint, it’s an old-world of thinking that you have to have live sports programming 24/7 to justify having the network,” Canzano told Front Office Sports. “They’re in a tough spot because they’ve got a lot of subscribers expecting them to put out quality content. But they just laid off most of their staff — including their entire digital staff. So I don’t know how they’re expected to put together any kind of quality programming.”

Founded in 2012, Pac-12 Networks consists of one national channel and six regional channels.

If workers are going to be set adrift in the teeth of a pandemic and media recession, said Canzano, then the Pac-12 Conference should also cut the executive salaries of Commissioner Larry Scott, Pac-12 Networks President Mark Shuken and Executive Vice President of Content Larry Meyers. Or seek a less-expensive headquarters location than downtown San Francisco.

“The correct response would have been to look at cost-cutting measures that were more obvious like real estate in downtown San Francisco — and the bloated executive salaries,” Canzano said. “Invest in local programming and good shows that involve interviews with the conference’s coaches and personnel that viewers would be interested in.”

Pac-12 Networks declined to comment.

Meanwhile, the Big Ten Conference also decided to postpone fall sports, including the 2020 football season for powerhouse schools like Ohio State. But the 12-year old BTN is better positioned to ride out the storm until sports, hopefully, return in the spring, according to John Kosner, the former ESPN executive turned founder of Kosner Media.

For one thing, BTN is a joint venture between the Big Ten Conference and Fox. That ameliorates losses during economic slowdowns. That means they also have a deeper, more varied library of programming content to re-air when there are no live games.

Until the live games return, Kosner expects these college networks to do what ESPN and NBCSN did until pro sports came back. Namely, show reruns of “classic” football and basketball games. Even if advertisers are laying low now, they’ll eventually come back. Until then, these networks must do what they have to do to survive.

“When all sports shut down, ESPN became ESPN Classic. Then when they had live events to put on, they put on live events. You just do the best you can,” Kosner said.

Sports’ Cruel Summer

Original Article: By John Kosner and Ed Desser for Sports Business Journal, August 5th, 2020

Back in March, the NBA led a series of “postponements” and the sports industry hunkered down with the hope that play could resume over the summer. Sports has experienced a lost (NHL) season and shortened (NBA, NFL and MLB) ones before, but had never been entirely “on hiatus.” Now, we’re mid-summer, and the re-starts have begun (motorsports, golf, MLB and, last week, the NBA and NHL, so far successfully in their respective bubbles). Amidst the progress, however, the nationwide spike in COVID-19 infections is feeding a new crisis. On July 23 in “Bloomberg” Opinion, Joe Nocera wrote under the headline, “Covid-19 Has the Power to Break the Sports World.” Back on May 1, ESPN published an economics study that found: “The sudden disappearance of sports will erase at least $12B in revenue and hundreds of thousands of jobs, an economic catastrophe that will more than double if the college football & NFL schedules are wiped out this fall by the coronavirus pandemic.”

The $ 11-figure scenario may be upon us this fall. Here’s why:

1. The precariousness of staging sports during COVID-19. In the Wall Street Journal on July 16, Jack Swarbrick, the Athletic Director at Notre Dame, reported, “We’re mid-July and the trends are the wrong way … it’s the environment around us collapsing.” Notre Dame is arguably the most storied school in college football, the only one with its own broadcast TV agreement, and yet it’s already lost games with Stanford, Wisconsin and USC. It may even (gasp) play in the ACC!

2. Sports is in a period of profound uncertainty – and that uncertainty only goes one way. Stanford University, with perhaps the nation’s leading intercollegiate men’s and women’s sports programs (and huge endowment), just unilaterally eliminated 11 sports. And this was two days before the Pac-12 joined the Big Ten in announcing a conference-only college football schedule. Pro and college leagues, schools and organizations are subject to frequently changing Federal guidelines, individual state mandates and issues, and international decisions including managing quarantine orders. On July 18, Canada forbade the Blue Jays playing MLB games in Toronto this season, and in a Bills reversal, they will call Buffalo home.

3. Challenges abound. Among them: long-distance travel (a result of bigger and more consolidated college conference TV agreements), the vagaries and expenses of necessary testing (per the WSJ, the NFL’s 2020 COVID-19 testing plan could run approximately $75M), PPE and cleaning for both practice facilities, stadiums and arenas. Keeping everyone safe is harder and harder; especially with all of the professional and collegiate teams in states where COVID-19 is on the rapid rise – such as Florida, Arizona, Texas and now California. Last week, Pac-12 and SEC student athletes challenged their conference leadership on the efficacy of return to play plans. Of all the sports, golf appears the best situated to “play through” as the sport already lends itself to distancing and revised plans still call for no spectators.

4. The unprecedented nature of COVID-19 on Sports – the first existential crisis for the sports industrial complex. Even during World War II, when sports stars went to war and the U.S. rationed food, Major League Baseball continued to play (thanks to FDR, and women’s teams made famous in the movie “A League of their Own” picked up the slack), the World Series was played and fans attended. Today, sports is a multi-billion dollar enterprise built on long-term contracts and planning cycles. COVID-19 is upending, compressing and extending everything.

5. Perishable events and revenue. Yes, the strongest sports leagues like the NFL could conceivably power through COVID-19’s first and second waves (having the benefit of generating the majority of revenue from media – but facing the challenge of a sport that features heavy-breathing men piled on top of each other for significant, repeated periods of time), extending their season into the spring of 2021, if necessary. But most other sports, including college this fall, are facing cancellations of perishable events – like the 2020 NCAA Basketball Championship. The financial implications are calamitous. Two sports – college football and men’s basketball -- finance almost all the other intercollegiate programs and both are in jeopardy; the Tournament pays the NCAA’s annual operating expenses!

6. The Ramifications of COVID-19 on Sports. Today everything is interconnected. The sports industry is not just owners, players, TV networks, TV distributors and facility owners, but all of the people who work behind the scenes and all of the businesses interconnected are impacted. What does State College, PA look and feel like without Penn State football?

7. A changed and limited sports fan experience. What does the betting industry look like without football season? According to Sponsor United CEO Bob Lynch, there are approximately 450 advertising brands highly active in sports – the Super Bowl is its own phenomenon. Anheuser-Busch can sell you beer at home as well as at the pub, but with bars closed or re-closing, videos have surfaced of proprietors and brewers dumping expired kegs down over-taxed sewers because they can’t serve them to customers;

8. The Psychological impact of COVID-19 on Sports. What happens if the eagerly anticipated fall collision of virtually all major sports doesn’t fully happen? Will MLB fans steeped on the game’s traditions and unique statistical history embrace the 60-game season and its expanded Playoffs*? Will MLB’s already teetering non-Bubble plan last that long? Not only is the sports hiatus unprecedented but also today’s fans have virtually unlimited internet entertainment to fill their time. There is Netflix and an ever-expanding array of subscription VOD services (Peacock is the most recent addition). Perhaps, most important, is the rise of free, user-generated powerhouses like TikTok, Snap and Instagram. COVID-19 is a daunting adversary for sports, but the bigger, longer term threat is the free content algorithms driving social media platforms, especially among young fans.

Still, nothing matches Sports’ unique ability to command attention and galvanize communities. Society misses sports desperately right now, and ratings are thus high.

In the Cruel Summer of 2020, Sports faces both the immediate challenge of returning to play and then the even harder work necessary to restore itself to its historically dominant place in our culture amid upheaval in both the media business and society at large.

Ed Desser is President of Desser Media (www.desser.tv), a sports media consultancy. He was the senior media executive at the NBA for 23 years. John Kosner is President of Kosner Media (www.kosnermedia.com), a digital and media consultancy and an investor and advisor in sports tech startups. He was the senior digital executive at ESPN for 20 years. Together they ran broadcasting for the NBA in the 80’s and 90’s.

Kosner: “An Unforgiving Time” for Digital Sports Media Start-Ups

Original Article: Sportico, by John Wall Street, August 4th, 2020

Defector Media and the Local Media Consortium (think: an alliance of local media outlets) announced their respective plans to enter a crowded digital sports media landscape last week. Defector Media, a content co-op formed by 18 former Deadspin writers and editors, will launch a podcast later this month; their website will follow in September. The content and tone of the brand is expected to resemble that of the outlet the group collectively quit last year.

The Matchup, an effort by the Local Media Consortium to give sports fans access to more news about their favorite teams, will get started by making local publications available to all readers (their destination site will launch in ’21). A subscription to any one of the consortium’s individual publications will give the subscriber access to sports content from all of the outlets (without any additional cost).

The two companies intend to take vastly different approaches to the business (Defector will be subscription-based, while The Matchup will rely on advertising). But John Kosner (President, Kosner Media) says that “fundamentally, it’s an unforgiving time for either to enter the marketplace.” Existing competition aside, “the generation coming of age prefers video to print” (so any audience built threatens to age out over time), and much of the current generation of fans is pre-occupied with recovering from COVID-19, finding work or home-schooling their kids to allocate additional time and money to more sports content.

Our Take: The former CEO of a prominent sports media outlet said there is “enormous value”—from the fan perspective—in having access to the 2-5 articles/week that they might want to read but currently can’t because they reside behind a paywall (and it’s unrealistic to subscribe to each publication individually).

The former chief executive we spoke to called The Matchup “a death sentence” for The Athletic, another outlet operating on a ‘subscribe to one market, get the rest free’ model. That’s because despite having raised +/- $140 million in venture capital, it lacks the resources Google has (Google Media Initiative is funding The Matchup) and has significantly greater operating costs. While The Athletic has to fund its expansive network of writers, “the technology, the app, the marketing and the promotion [of all the content], all Google has to do [to put out a comparable product] is build the technology and the distribution opportunity, and they win. They’re building a publishing company without having to incur any of the costs.” If Google can get The Matchup to scale, it’s reasonable to assume sports won’t be the last digital media vertical the tech giant enters (think: news, business).

If there’s a reason to believe The Matchup is going to fail, Kosner says it’s because “there is no future in ad supported media”—not with a few outlets controlling the bulk of ad dollars (think: Facebook, Google, Amazon, YouTube, Snapchat). Brands have also stopped spending with newspapers over the last decade (see: advertising revenue is about 1/3 of what it was in 2008). But the former CEO we spoke to didn’t see that as a problem. They said advertisers wouldn’t look at The Matchup’s offering as “spending money on newspaper advertising. [Instead], they will look at it as spending ad dollars on a digital audience and trust that Google Adwords is able to funnel a certain amount of guaranteed money towards them.”

While the two c-level executives we spoke to didn’t necessarily see eye-to-eye on The Matchup, there was a consensus on Defector Media’s prospects: Neither believes the company is positioned to thrive in the current media environment. While Kosner readily acknowledged Deadspin did some fine reporting in its day and that several talented journalists have worked for the company, he isn’t convinced that the brand has a large enough following to operate on a subscription model. He pegged the entirety of their audience (i.e. those willing to read their free content) “probably in the hundreds of thousands of people—not in the millions.”

Defector had 10,000 subscribers (self-reported) sign-ups within the first few days. While that may sound like a lot, $960K in gross revenue ($8/mo.) obviously isn’t nearly enough to sustain a digital publishing company with 20 employees and real ambitions. The former CEO we spoke to isn’t expecting “that number to go up in any significant way from here, [either].” They said, “There’s a reluctance among consumers to sign up for paid products (only enhanced by the recession), and I just don’t see the former Deadspin crew—who lack relevance on an individual basis—[being another subscription most people would be willing to pay for]. If you told me that it was Bari Weiss, Andrew Sullivan and a bunch of big names were [pursuing this model, they would have a greater chance at success].”

It’s important to remember that “the media environment is also vastly different now [than when Deadspin was at its peak].” Kosner explained, “When Deadspin started in 2005 it was unique, and they had their own voice. Today, [that voice] is not particularly unique. In fact, a website with [the Deadspin] name still exists, trying to do some of the same things [this group wants to do].” The former CEO agreed, adding that the company no longer has a clear role in the sports media ecosystem. “They won’t be as high-minded journalistically as The Athletic,” They said. “They won’t be as deep and in the know as ESPN. They won’t be as much of a utility as Bleacher Report or as funny to enough people as Barstool. If someone really wants to read snark around sports, and they’re right wing they’ll read Outkick and if they’re left wing they’ll read Awful Announcing.”

Perhaps the biggest problem Defector Media faces is that some of its talent will inevitably bring more value to the outlet than others (think: revenue, attention)—a recipe for disaster when everyone is being compensated equally (or close to it). The former CEO explained, “The second somebody starts doing way better than the others, my guess is they fight, they split up and those who are doing great just make the move over to Substack.” Retaining top talent is always going to be a challenge.

Covid-19 Has the Power to Break the Sports World

Original Article: Covid-19 Has the Power to Break the Sports World, by Joe Nocera, July 22nd, 2020

“Staging sports right now is precarious and unprecedented,” said John Kosner, a sports business consultant and former ESPN executive. After decades of growth and prosperity, he added, “it is sports’ first existential crisis.”

Watch John Kosner at the N3XT Sports panel with Rick Welts

Original Article: N3XT Sports, July 16th, 2pm EST

Re-watch the panel with John Kosner and Rick Welts from the Golden State Warriors online, or read a quick recap on the N3XT website.