John Kosner Spoke with Mike McCarthy of Front Office Sports About the Future of the Super Bowl

Original Article: Front Office Sports, by Mike McCarthy and A.J. Perez, February 12th, 2023

More than any major sports league, the NFL embraces systemic change.

Next year, the NFL kicks off the first season of its 10-year media rights cycle with Disney’s ESPN, NBCUniversal’s NBC Sports, Fox Corp.’s Fox Sports, Paramount’s CBS Sports, and Amazon’s Prime Video that runs through the 2033 season.

But once those $110 billion-plus deals expire, all bets could be off.

After leading the fight against sports betting, the NFL did a complete about-face. It now has a sportsbook on the same site as this year’s Super Bowl.

Over the decades, the NFL extended its regular-season game schedule from 12 to 14 to 16 to 17 games. To hell with historical player stats a la Major League Baseball. This league’s all about the future.

Seeking to turn itself into a year-round sport, the league successfully transformed the formerly sleepy NFL Draft into must-see TV. The rapacious NFL has invaded the rival NBA’s stronghold of Christmas Day. Next year it will play a game on Black Friday for the first time.

What’s stopping a global pay-per-view bonanza to beat all pay-per-views? What about playing the NFL championship across the pond?

Let’s get into the time machine and talk about the future of the Big Game.

What If It Isn’t Free?

How much would you pay to watch the Super Bowl 10 years from now?

Yes, the NFL has built its popularity on free television and has broadcast all Super Bowls across over-the-air networks, including this Sunday’s Super Bowl 57 on Fox Sports.

But you can never say never — especially with the NFL potentially able to charge homes hundreds of dollars a pop.

Former ESPN president John Skipper boldly predicted the Super Bowl would eventually leave broadcast TV for a paid streaming or PPV platform. If sports fans are willing to pay to watch Floyd Maywather fight an exhibition boxing match vs. Logan Paul, then surely they’ll pay to watch the biggest, most important sporting event of the year.

“Super Bowl — take that to pay-per-view,” Skipper told Dan Le Batard. “That’s how they’re going to replace the [advertising] money someday.”

PPV expert Joe Hand Jr. told Front Office Sports that a Super Bowl PPV would easily shatter the record for highest-grossing PPVs of all time, saying the NFL could easily charge $200 a home.

Subscriptions and VR

A decade from now, media consultant Patrick Crakes sees the Super Bowl placed behind a paywall.

It will be a paywall that doesn’t exist yet — but one that will boast enough subscribers to reasonably replicate the reach offered by today’s broadcast TV.

“Think of it as a natural evolution from a standalone broadcast TV system to the hybrid system of today, and over to one with just a few paywall video providers with the scale to replicate the current retransmission fee and advertising revenue model that’s nearly tapped out as a high-margin economic source,” said the former Fox Sports executive.

John Kosner, a former ESPN executive, agreed with Skipper’s PPV theory. But only to a point.

Yes, there will be PPV options for future Super Bowls. But not in the way we define PPV today, he said.

By the mid-2030s, he sees the NFL keeping the Super Bowl on free TV — but also selling a variety of lucrative, high-tech viewing options to fans.

Fans will be able to buy virtual reality headsets that immerse them in the game, he predicted.

There will also be volumetric 3D video that gives customers the same on-field view as the quarterbacks. Not to mention a slew of new audio, statistical, and co-viewing options for sale.

“As great a spectacle as the Super Bowl is, we probably haven’t seen anything yet,” Kosner said. “We may just have to pay something for it.”

Future of Betting

The NFL has deals with Caesars, DraftKings, FanDuel, FOX Bet, BetMGM, PointsBet, and WynnBET, and Sunday’s game will be the first to have a sportsbook on the same property as a host Super Bowl venue.

With around two-thirds of states offering some form of sports betting, the American Gaming Association projected 30 million people in the U.S. will place a legal sports wager on this year’s Super Bowl — a 66% increase from last year’s game.

Leigh Steinberg, the legendary agent who represents Kansas City Chiefs quarterback Patrick Mahomes, sees betting evolving and growing over the next decade.

But Steinberg said there’s a potential downside.

“They’re going to have to be very rigid,” Steinberg told FOS. “The existential threat to professional sports is the concept that the games might not be played on a level playing field. And if they ever suspected someone was holding back their performance [due to betting], it would be a disaster.”

Cathy Lanier took over as the NFL’s chief security officer nearly two years before the Supreme Court’s decision in May 2018 that allowed all states to offer state-sanctioned gambling as Nevada had for decades.

“It’s always been part of my job. It’s a bigger part of my job now,” she told FOS. “Like everything else that we do, it’s about relationships. We have very good, well-established relationships, both with [state] regulators along with the sportsbooks themselves. If there are any violations of policy, we take those very, very seriously.”

Last year, the NFL suspended Atlanta Falcons receiver Calvin Ridley and New York Jets receivers coach Miles Austin for violating the NFL’s gambling policy.

Arms Race

The viewing and betting experience isn’t the only thing that could change — the in-person experience is going to get bigger and better.

Across the country, there’s an arms race to host the most popular sporting event in the country. The key: a shiny new stadium.

Last year’s Super Bowl, for example, was hosted at the new SoFi Stadium in Los Angeles. The facility has only hosted events since 2020.

The next Super Bowl will be at Allegiant Stadium in Las Vegas — which also opened in 2020 to accommodate the Raiders’ move to Sin City.

To entice the league, teams like the Titans and Bills have released billion-dollar plans for new stadiums.

The Titans are working on a $2.1 billion project for a 1.7 million-square-foot stadium seating around 60,000. The stadium will have not only a see-through roof, but panoramic views of the city as well. In Buffalo, the Bills are working on a $1.4 billion stadium that could be ready by 2026. Both are slated to receive massive public funding.

Others, like the Dallas Cowboys, are committing millions to renovations — even to stadiums less than a decade old.

International Waters?

The destination outside the stadium matters to the NFL, too. After all, the league is interested in using the event to build fanbases in new regions.

If you thought Las Vegas — once a sporting event pariah — was an unexpected future host, try a city that isn’t in the United States, or even North America. It’s more than possible that a future Super Bowl could land in the U.K., Europe, or Mexico.

Regular-season games in London and Munich have been popular, and Commissioner Roger Goodell has said he’d be interested in placing not one but two teams in London. The Premier League’s Tottenham Hotspur FC were reportedly interested in hosting the Super Bowl at their London stadium.

Whether the overseas ambitions materialize or not, one thing is certain: We can’t expect America’s most popular moment across sports and entertainment to stay the same forever.

John Kosner Spoke with Mike McCarthy of Front Office Sports about FOX Sports’ Talented, Young Super Bowl Announcer Team

Original Article: Front Office Sports, by Mike McCarthy, February 10th, 2023

PHOENIX — The joke about No. 1 NFL TV analyst jobs is they’re like Supreme Court appointments: The lucky few serve for life.

But this elite, highly-paid fraternity will be upended this Sunday as a pair of Super Bowl rookies take over the broadcast booth.

Greg Olsen and Kevin Burkhardt will call Fox Sports’ telecast of Super Bowl 57 Sunday night between the Kansas City Chiefs and Philadelphia Eagles.

It’s been a season of firsts for the 37-year-old Olsen and 48-year-old Burkhart: a pair of Jersey Boys whose relationship dates back to Olsen’s high school football days in Wayne.

On Thanksgiving, the duo called the most-watched NFL regular-season game ever: Dallas Cowboys vs. New York Giants, which drew a record 42 million viewers.

Then they called the Philadelphia Eagles’ 31-7 win over the San Francisco 49ers in the NFC Championship Game. Despite the lopsided score, it averaged 47.5 million viewers.

“I’d called playoff games, but I’d never called a Championship Game,” Burkhardt told Front Office Sports. “So, that was pretty special two weeks ago. Just to get a chance to do that and call a team into the Super Bowl was awesome.”

The ascension of Olsen and Burkhardt underscores how few announcers have called America’s Game.

Immovable Objects

For nearly six decades, the NFL has rotated the lucrative Super Bowl assignment between partner broadcast TV networks paying billions for rights: Fox, NBC Sports, CBS Sports, and the old ABC Sports. The top on-air talents at these networks were usually in place for decades.

The result? Only seven announcers have called the Super Bowl from the broadcast booth since 2010 (That number doesn’t count various sideline reporters and rules analysts over the decades).

NBC’s Cris Collinsworth-Al Michaels, Fox’s Troy Aikman-Joe Buck, and CBS’ Tony Romo-Phil Simms-Jim Nantz have called the last 13 Super Bowls.

If you add Greg Gumbel and the late John Madden and Pat Summerall to the list, a total of 10 announcers have called the Super Bowl since 2001.

The only outlier in the 21st century was Boomer Esiason, who called his one and only Super Bowl on ABC with Michaels in 2000. (The duo hated each other and split the next year. Esiason continued to call the Super Bowl on Westwood One Radio.)

Even when announcers change jerseys, the song remains the same. After calling six Super Bowls together at Fox, Aikman and Buck are poised to call ABC/ESPN’s Super Bowls after the 2026 and 2030 seasons.

Another benefit to Fox? Younger announcers come cheaper.

Olsen is making about $10 million a year, said sources, compared to $12 million for Collinsworth and $18 million for Aikman and Romo.

Sports media consultant John Kosner gives credit to Fox for “zigging” where other networks have zagged.

“They have gone with younger, far less expensive broadcast talent. And coming into the Super Bowl they appear to be a big winner,” said the former ESPN executive. “Kevin Burkhardt and Greg Olsen are appealing. They certainly seem to like each other and they are rising to the occasion. Burkhardt gives Olsen a lot of room. In return, Olsen is insightful, energetic and fearless.”

Changing of the Guard

The genesis for this year’s changing of the guard actually dates back to 2017. That’s when CBS boss Sean McManus shocked the industry by hiring TV rookie Tony Romo for the No. 1 analyst job with Nantz. As a result, longtime No. 1 Phil Simms was shifted to “The NFL Today” pregame show.

Until that decision, the NFL TV scene was a much quieter place. Most top analysts had held their seats for years.

Simms had served as CBS’ lead analyst for 19 years. Aikman and Buck had reigned as Fox’s No. 1 team since 2002. Collinsworth was entering his ninth season with Michaels at NBC. And Jon Gruden was heading back to the NFL after nine pedestrian years in ESPN’s “Monday Night Football” booth.

Olsen actually announced games for Fox while still an active NFL player. During the 2021 season, he and Burkhardt moved up to the No. 2 team.

When Aikman and Buck both jumped to ESPN’s “Monday Night Football,” the duo were promoted to the A Team. As opposed to studio analysis, Olsen enjoys the unscripted nature of calling a game live.

“Yeah, you’re definitely nervous,” Olsen told FOS. “You’re definitely anxious. I mean, you’re gonna be speaking on live television for three hours about a live sporting event that you have no idea what’s really gonna happen. So, you better be prepared for pretty much everything, and be able to rattle it off and spit it out.

“To me, that’s the fun of it. Like that’s the challenge of why I was kind of driven to calling games, as opposed to some of the other stuff, because I think it’s hard to do and I’ve enjoyed that challenge.”

Olsen and Burkhardt will lead a broadcast team of experienced veterans, including sideline reporters Erin Andrews and Tom Rinaldi and rules analyst Mike Pereira.

They can also rely on Fox NFL lead game director Rich Russo and Richie Zyontz, the network’s lead NFL producer. The duo have been part of 29 Super Bowl productions combined.

“They know the enormity of this event,” Russo said. “I know they haven’t done the game. It’s a bigger audience so, you’ll have to pull back a little bit as far as in-depth analysis, but that’s something Greg does well. He’s a great teacher of the game.”

What About Brady?

This week, Tom Brady told Colin Cowherd he’ll be ready to start his 10-year, $375 million gig as Fox’s No. 1 color analyst in 2024.

That means Brady will presumably call Fox’s next Super Bowl after the 2025 season — while Olsen drops down to No. 2 analyst. He’ll lose his productive on-air partnership with Burkhardt, who will become Brady’s partner. His pay will likely be slashed as well.

Without Burkhardt as his partner, Olsen will have to decide whether he wants to stay at Fox. Or if she should pursue a No. 1 job at another network like NBC or CBS. The wisest move would probably be to play the long game at Fox and see if Brady lasts on TV.

Jimmy Johnson, the Super Bowl-winning Dallas Cowboys coach turned analyst for “Fox NFL Sunday,” thinks Brady will benefit from a year off. As with his football career, he expects the seven-time Super Bowl champion to defy expectations in the booth.

“I think Tom Brady will be outstanding. He will work at it for a year. He’ll prepare himself,” Johnson said.

Meanwhile, Fletcher Cox, the star defensive tackle of the Eagles, would rather watch Brady on TV than play against him on the field.

“I think he’ll do a really good job. He’s been around for a long, long time. He’s seen a lot of ball — and he knows ball,” Cox said.

While Fox says the legendary QB won’t appear on Sunday’s coverage, Brady told Cowherd he’ll tune in to check out his future colleagues Olsen and Burkhardt this Sunday.

“I will be 50% watching the game. And 50% listening to those two – and hearing the amazing job they’re going to do, along with the whole Fox Sports crew,” Brady said.

John Kosner Spoke with Ben Strauss of the Washington Post About the New LIV Golf TV Deal with The CW Network

Original Article: The Washington Post, by Ben Strauss, January 19th, 2023

LIV Golf finally will arrive on American TV.

The year-old upstart golf series announced Thursday that it had secured its first television contract with the CW Network, which will air all 14 of its events in 2023.

The deal is an important step for the viability of the series but also an indication of how far it still has to go. LIV had talks with other networks and streaming services, including Amazon and Apple, but had to settle for a deal with the CW, which does not air other sports properties and is not a traditional destination for sports fans.

“It’s better for them than where they were,” said John Kosner, a former ESPN executive turned industry consultant. “I’d rather be live broadcast on the CW and streamed on their app than just putting my events on YouTube without any kind of promotion. So by definition it has to improve their audience.”

Kosner added: “But at the same time, it’s not likely to move the needle for them. The CW audience is not necessarily a fit for professional golf.”

No financial details were released of what LIV described as a “multiyear partnership.” A person who is familiar with the deal but not authorized to discuss it publicly said LIV will continue to do its own production. There had been some speculation that LIV would buy airtime on a network. The person said that was not the case but declined to go into detail about LIV’s compensation. CW will be in control of selling ads for LIV programming.

In its first season last year, LIV failed to find a television partner, leaving its eight tournaments to be streamed on its website, YouTube and the DAZN streaming service. YouTube viewership was low, even though several popular golfers — including major winners Phil Mickelson, Dustin Johnson, Cameron Smith and Bryson DeChambeau — had left the PGA Tour for the new series, which is funded by Saudi Arabia and has been accused of trying to paper over that country’s human-rights violations.

[From October: Inside the ropes at LIV Golf’s Saudi Arabianhomecoming]

LIV tournaments comprise three rounds, and the CW will offer television coverage for the second and third rounds on Saturdays and Sundays. First rounds on Fridays will stream on the CW app. “The CW will provide accessibility for our fans and maximum exposure for our athletes and partners as their reach includes more than 120 million households across the United States,” Greg Norman, LIV Golf’s chief executive and commissioner, said in a statement.

LIV’s agreement with the CW is the first sports deal for the network in its 16-year existence. Last year, Nexstar Media Group assumed a 75 percent ownership stake in the network — the lowest rated among the five major U.S. over-the-air television networks — from its previous owners, Paramount Global and Warner Bros Discovery, and promised to turn a profit by 2025, in part by reducing expenses.

Despite scripted programming that skews young, the median age for the CW’s prime-time viewer in 2021 was 57.4 years old. Televised golf has long had the oldest viewership among sports in the United States — in 2016, the average golf television consumer was 64 years old — so the CW’s agreement with LIV could be an attempt to provide programming for a demographic that already was watching the network without the costs involved with producing scripted entertainment.

“For The CW, our partnership with LIV Golf marks a significant milestone in our goal to re-engineer the network with quality, diversified programming for our viewers, advertisers, and CW affiliates,” Dennis Miller, president of the CW, said in LIV’s statement.

[From October: For its next stop, LIV Golf looks to take on the world]

The first tournament on LIV’s 2023 schedule begins Feb. 24 in Mexico. LIV events differ from PGA Tour tournaments in that they feature three rounds instead of four, much smaller fields, no cuts and shotgun starts, which means all of the golfers begin at the same time instead of the traditional staggered start. LIV also includes a team competition to go along with individual play, and the winners of both receive sizable monetary prizes that dwarf those awarded at PGA Tour events.

While the series is backed with seemingly endless Saudi oil money, LIV’s future as a viable golf concern may depend on whether its events become recognized by the Official World Golf Rankings (OWGR). While some of LIV’s golfers still can enter golf’s major events because of their status as past champions, the vast majority need to earn OWGR points to maintain their eligibility. LIV applied for OWGR recognition in July, but it generally takes one to two years for the organization to issue a ruling on new members. Without OWGR points, LIV golfers will see their world rankings plummet and their chances of competing in golf’s majors — the most visible tournaments on the sport’s calendar — fall with them.

The PGA Tour has banned all of the golfers who defected to LIV, though as of now they still can compete in majors if they qualify (the PGA Tour does not operate the Masters, PGA Championship, U.S. Open and British Open). Last year, the U.S. Department of Justice reportedly began investigating the PGA Tour for potential antitrust violations, and 11 LIV golfers sued the Tour, accusing it of using a monopoly to squash competition. About two months after the LIV players filed their lawsuit, the PGA Tour countersued LIV, accusing it of interfering with its contracts with players.

John Kosner Spoke with Jessica Toonkel of The Wall Street Journal About YouTube’s Launch of Free Ad-Supported (FAST) Channels

Original Article: The Wall Street Journal, by Jessica Toonkel, January 13th, 2023

YouTube is testing a new hub of free, ad-supported streaming channels, the latest in a series of moves by the company to expand its ambitions in video.

The Alphabet Inc.-owned video platform is in talks with entertainment companies about featuring their shows and movies in the hub of cable-like channels and is testing the concept with a small number of media partners, according to people familiar with the discussions. It could launch the offering more broadly later this year, some of the people said.

YouTube, already a dominant player in online video, is looking to become a go-to destination across various streaming formats and genres. Adding a hub of free, ad-supported streaming TV channels—or “FAST,” as it known in the media industry—would put it in competition with players such as Roku Inc., Paramount Global‘s Pluto TV and Fox Corp.’s Tubi.

The discussions follow other YouTube streaming initiatives, including its recent creation of a marketplace allowing users to sign up for paid streaming services and its deal to pay about $2 billion a year for rights to the National Football League’s Sunday Ticket franchise.

A YouTube spokeswoman said the company is running a small experiment that lets a subset of viewers watch free, ad-supported channels and is using it to gauge viewer interest. “We’re always looking for new ways to provide viewers a central destination to more easily find, watch and share the content that matters most to them,” the spokeswoman said.

YouTube generated $7.1 billion in advertising revenue in the third quarter of last year, 13% of Google’s total ad revenue during the period. The video unit’s ad revenue dropped in the period for the first time since Alphabet started reporting its financial performance in 2020.

Free, ad-supported TV services typically allow users to peruse a list of channels, as they would on cable TV, and dip in and out of content that is already playing. On Pluto TV, for example, viewers can scroll through reruns of shows from “Happy Days” to “South Park” to “This Old House”; rival Tubi also offers a range of fare, such as Samuel Goldwyn Classics, sports highlights and news programs such as Dateline NBC episodes.

It is a crowded but fast-growing area of the streaming business, with more than 20 free ad-supported TV platforms in the U.S., according to S&P Global Market Intelligence. The data provider expects ad revenue from that type of service to rise from $4 billion in 2022 to $9 billion by 2026.

YouTube has discussed taking a cut of ad revenue from the new hub that would be similar to its traditional arrangement with content creators, under which it gets 45% and allows the programmers to keep 55%, some of the people familiar with the discussions said.

Becoming a destination for ad-supported channels makes sense for YouTube given how much success other companies have had in the space, said John Kosner, chief executive of media consulting firm Kosner Media. “Why would YouTube cede ground to Pluto and Tubi and the rest of them?” Mr. Kosner said.

Late last year YouTube launched a new streaming service store called Primetime Channels that lets viewers sign up for subscription streaming services such as Paramount+ and Starz directly through YouTube.

YouTube also offers its own paid streaming service, YouTube TV, which lets users stream a package of major cable channels—from CNN to ESPN—for $65 a month. The NFL Sunday Ticket package will be offered as an add-on to YouTube TV as well as through Primetime Channels.

YouTube also has rolled out short-form videos, called Shorts, as it competes with social media giant TikTok for attention, particularly from younger audiences.

YouTube, which has more than two billion monthly users, accounts for the greatest share of U.S. TV viewing time of any streaming service, according to ratings firm Nielsen. It attracted 8.8% of Americans’ TV viewing time in November, beating Netflix Inc. for the third consecutive month. YouTube TV has at least five million subscribers and trial accounts.

YouTube has begun testing the new hub of free, ad-supported streaming channels with content suppliers, including Lions Gate Entertainment Corp., A+E Networks, Cinedigm Corp and FilmRise, according to people familiar with the tests.

Some streaming executives say the format offers a more relaxed or “lean back” viewing experience than other forms of content in which people actively select the program or film they want to watch. The content available is often comforting fare, “the macaroni and cheese of television and movies,” said Chris Buchanan, president of streaming consulting firm South Medio Partners.

Such services appeal to cost-conscious consumers. “Free is free and in times of economic hardship, free is even more important,” said Danny Fisher, chief executive of FilmRise.

Hollywood studios, smart-TV makers and streaming platforms alike are rushing to create such channels because they offer a way to broaden the reach of their content and make money from shows that might otherwise not be featured in major subscription streaming services.

John Kosner Spoke With Mike McCarthy of Front Office Sports About How ESPN Landed the Dallas @ Tampa Bay NFL Wild Card Playoff Game

Original Article: Front Office Sports, by Mike McCarthy, January 13th, 2023

Since the NFL announced its playoff schedule, the biggest question in sports media has been: How did ESPN land the biggest game of Super Bowl Wild Card Weekend?

The Walt Disney Co. will air Monday’s night Wild Card Weekend finale between the Dallas Cowboys and Tampa Bay Buccaneers across five networks (8:15 p.m. ET on ABC, ESPN, ESPN2, ESPN+, and ESPN Deportes).

The other NFL TV partners paying billions annually for game rights wanted Cowboys-Bucs badly. It’s easy to see why.

The Cowboys are the biggest TV draw in the NFL, playing in four of the five most-watched regular season games this season. Meanwhile, Monday’s game could mark the swan song for Bucs quarterback Tom Brady after seven Super Bowl titles and 23 seasons.

Even better, the prime-time blockbuster is the only NFL playoff game on the calendar Monday, after a doubleheader Saturday and a tripleheader on Sunday. That means the entire country (including the extended NFL family of players, coaches, and executives) will be tuning in.

Last year, ESPN had the Los Angeles Rams-Arizona Cardinals as Wild Card Weekend finale on Monday night. Not bad. But it’s not Cowboys-Bucs.

“The game will generate an epic rating – especially if it’s a close game,” predicted John Kosner, the former executive vice president of ESPN turned founder of the Kosner Media consultancy.

Then again, this is ESPN, the league partner that traditionally brings up the rear when it comes to the best NFL game matchups.

The partner that’s long been shut out of the Super Bowl rotation despite paying the most.

The network was prepared to exit the NFL game business entirely under former boss John Skipper.

The Worldwide Leader in Sports has been trying to patch up its previously strained relationship with the league for years.

In previous seasons, a matchup like Cowboys-Bucs probably would have gone to Fox Sports, which aired five of the ten most-watched NFL games this season. Or CBS Sports, which aired the Cowboys’ Wild Card game against the San Francisco 49ers last year on Sunday at 4:30 p.m. ET.

Both the NFL and ESPN declined to comment on this story. So we asked Kosner and other sports media executives why ESPN landed America’s Team. Here are five reasons:

Makeup Game: ESPN lost the biggest game on its “Monday Night Football” schedule when Damar Hamlin’s shocking on-field collapse caused the NFL to postpone, and eventually cancel, the Buffalo Bills vs. Cincinnati Bengals game on January 2. “They did it to make up for the loss of Bills-Bengals,” said one rival TV executive.

Troy Aikman/Joe Buck: ESPN recruited Troy Aikman and Joe Buck from Fox to create a new “Monday Night Football ” announce team with Lisa Salters and John Parry this year. With six Super Bowls and over 300 games, they’re the longest-running broadcast team on NFL TV. ESPN will pay the duo $165 million over the next five years. But they’re already paying dividends. The new booth helped ESPN land a more robust MNF game schedule this year and its first two Super Bowls after the 2026 and 2030 seasons.

Peyton/Eli Manning: As if the new MNF announce team isn’t a big enough draw on ESPN and ABC, ESPN will offer the funny, free-wheeling Manning brothers with their “Manning-Cast” on ESPN2. Both versions of the game will be available on ESPN+.

Jimmy Pitaro/Burke Magnus: Ever since former Disney executive Jimmy Pitaro got the top job in Bristol three years ago, the ESPN chairman and president Burke Magnus have made it their mission to fix the broken relationship with NFL brass on Park Avenue. It’s working. The two executives have done “a superb job” improving the NFL relationship, noted Kosner.

The Disney Factor: ESPN’s NFL relationship has really become a Walt Disney Co. relationship. Over the last few years, the Burbank-based entertainment giant has become increasingly tight with the NFL.

No company can “flood the zone” like Disney when it wants to. Consider ESPN’s Super Bowl-like coverage plan for Cowboys-Bucs.

ESPN will offer fans in Tampa the chance to attend live versions of “First Take,” “NFL Live,” and “Monday Night Countdown.”

On Sunday, sister Disney networks FX, FXX, and Freeform will run a 12-hour marathon of football programming, including movies like “Remember the Titans,” “The Blind Side” and “Invincible.”

During’s Monday’s episode of “First Take,” Stephen A. Smith, Ryan Clark, Michael Irvin, and Molly Qerim offered “props” to Aikman and Buck for helping them land the Big Game.

“We salute you,” said Smith.

John Kosner Spoke With Ben Mullin of The New York Times About Google / YouTube’s Acquisition of NFL Sunday Ticket Rights

Original Article: The New York Times, by Ben Mullin, December 22nd, 2022

For years, live sports has been the last stitch holding the cable television bundle together even as more major games moved to streaming services. Apple snatched up Major League Baseball games. Amazon scored Thursday Night Football. But the National Football League’s Sunday games, a centerpiece of American sports, have remained defiantly tied to traditional TV.

Until today.

On Thursday, YouTube and the National Football League announced that they had reached a deal for the N.F.L.’s Sunday Ticket package of games, as the tech giants Apple, Amazon and Alphabet, which owns YouTube, use their deep pockets and huge platforms to transform the business of live sports rights.

“I think it’s a seismic deal,” said John Kosner, a former ESPN digital executive and the chief executive of the media consultancy Kosner Media. “With this deal, the three major sleeping giants have all woken up.”

The deal will allow YouTube viewers to stream nearly all of the N.F.L. games on Sunday next season, except those that air on traditional television in their local markets. Games will continue to be available on other networks throughout the week, including Monday night games on ESPN and ABC and Thursday evening games on Amazon’s Prime Video service.

The games will be available as an add-on for an additional fee to YouTube TV, the company’s $64.99 streaming package, or available for purchase separately through its YouTube Primetime Channels, another product.

The new Sunday Ticket deal could be worth as much as $2.5 billion annually, including payments from YouTube and separate agreements to license the package to businesses including bars and restaurants, according to people familiar with the negotiations. That’s about $1 billion a year more than DirecTV, the previous rights holder. The deal includes payments based on the number of YouTube subscribers that Google is able to add, as well as other performance benchmarks, the people said.

YouTube struck a seven-year agreement for Sunday Ticket, one of the people said, a long-term deal to give Google time to build its subscriber base. DirecTV also agreed to long-term deals.

“For a number of years we have been focused on increased digital distribution of our games, and this partnership is yet another example of us looking towards the future and building the next generation of N.F.L. fans,” Roger Goodell, the N.F.L. commissioner, said in a statement.

Still, a major chunk of N.F.L. games will be exclusive to traditional television for the next decade. Last year, the league struck decade-long deals with major U.S. TV networks, including Fox, ESPN, CBS and NBC. In recent years, the league has tried to generate extra income by selling streaming rights separately.

RedZone, a popular feature that allows fans to monitor Sunday games when teams get within scoring range, will no longer be available on DirecTV, but the N.F.L. will continue producing its own version of the broadcast, according to two people familiar with the matter, who spoke on condition of anonymity because they were not authorized to speak publicly. That feature will be available to users through cable providers, such as Comcast, or through their Sunday Ticket subscription on YouTube.

In recent months, the league explored selling a stake in the N.F.L. Network, its media arm, as part of the Sunday Ticket package. Those talks did not result in a deal, and the N.F.L. will continue those talks, the two people familiar with the matter said.

Robert Kraft, the owner of the New England Patriots and chairman of the league’s media committee, said the N.F.L. had used emerging technology for decades to reach fans, including cable and satellite TV. He added that YouTube would also provide N.F.L. fans with seamless access to game statistics and fantasy football results.

“Now, it’s time to move to a new platform to reach younger fans and YouTube makes the most sense,” Mr. Kraft said.

The Sunday Ticket package could prove to be a boon to YouTube, which has been keen to expand its subscriptions as its main business — advertising — has stalled. Football games could draw more sports fans to YouTube TV, which is already the most popular internet-based pay-TV service. The company said in July that it had five million subscribers, surpassing Hulu + Live TV.

YouTube gets the bulk of its revenue from advertising on videos uploaded by users. Stubborn inflation and a slowing economy have prompted advertisers to pull back spending, causing YouTube’s ad sales to contract almost 2 percent in the past quarter, Google’s parent company, Alphabet, reported in October.

The disappointing results have given more urgency to a yearslong plan for YouTube to expand in other ways. The company said in November that it had 80 million paying subscribers for its music and ad-free premium services, up from 50 million a year earlier. YouTube said this year that YouTube TV had more than five million paid and trial users.

“YouTube has long been a home for football fans, whether they’re streaming live games, keeping up with their home team or watching the best plays in highlights,” Susan Wojcicki, the chief executive of YouTube, said in a statement.

The deal culminates years of industry speculation over who would land the coveted package of games that began in 2019 when John Stankey, who was the chief operating officer of DirecTV’s former owner, AT&T, said the company was rethinking its deal for Sunday Ticket.

It became clearer that the package would go to a tech company in July when Mr. Goodell, the N.F.L. commissioner, said in an interview that a streaming service would be “best for consumers.” Apple, Amazon and YouTube emerged as the likeliest candidates, and all three companies vied for the rights.

Recently, Apple — long considered the front-runner — decided to drop its pursuit. As the negotiations stretched on, Apple became skeptical that the Sunday Ticket package was worth what the N.F.L. was seeking and ended serious conversations about a potential deal, a person with knowledge of the deal said.

Apple instead homed its focus on completing a deal to sponsor the halftime show for the 2023 Super Bowl, which it believes will raise the profile of its Apple Music service.

YouTube, on the other hand, resumed the negotiations after Thanksgiving, and the companies hammered out a deal within weeks.

Tripp Mickle contributed reporting.

Benjamin Mullin is a media reporter for The Times, covering the major companies behind news and entertainment. @benmullin

Ken Belson covers the N.F.L. He joined the Sports section in 2009 after stints in Metro and Business. From 2001 to 2004, he wrote about Japan in the Tokyo bureau. @el_belson

Nico Grant is a technology reporter covering Google from San Francisco. Previously, he spent five years at Bloomberg News, where he focused on Google and cloud computing. @nicoagrant

"We’ve Officially Crossed the Sports Media Rubicon," John Kosner's Latest SBJ Column with Ed Desser

Original Article: Sports Business Journal by John Kosner and Ed Desser, December 5th, 2022

Our industry reached its point of no return (the “Rubicon”) on Sept. 15, 2022. That’s when Amazon Prime’s streaming service delivered 15 million viewers for an exclusive NFL game, more (and younger) than via traditional pay-TV on NFL Network the same Thursday (Week 2) last season. Under the leadership of Marie Donoghue, Amazon’s technology survived the pressure test. Its Super Bowl-level production complement of six TV trucks and announcers Al Michaels and Kirk Herbstreit provided shock and awe-worthy coverage of the excellent Kansas City-San Diego matchup.

Sept. 15 was a tipping point for sports media. It’s been 35 years since a comparably transformative event — Nov. 8, 1987, when ESPN televised its first NFL game. That telecast heralded an earlier crossing of the Rubicon, starting the sports media balance of power shift to pay-TV from broadcast — buoyed by cable’s then-unique dual revenue streams of affiliate and advertising revenue. In fact, the start of the cable shift, and introduction of daily national prime-time sports, began a decade earlier. In 1977, Ted Turner put Braves games on his Atlanta Channel 17 “SuperStation,” novelly distributed via satellite, to content-hungry, growing cable systems nationwide. Similarly, streamers have been carrying live sports in recent years — just not close to what Amazon achieved this fall.

Over the past four decades, the cable TV industry’s desire to build out its technical plant, and motivate 90% of U.S. TV homes to subscribe, drove cable networks like ESPN to program nightly live major league sports and others to offer uncut, commercial-free movies, 24/7 news, original kids content and music videos. Today, crown jewels like “Monday Night Football” and the college football championship air exclusively on cable, which also has deals for all major pro leagues and college conferences. Sports has proven its unique ability to drive distribution before (NFL putting Fox on the map; and NBA making TBS a full national service, then launching TNT). The best entertainment programming has already made the move: Amazon, Netflix, and HBO Max regularly win awards for best drama, comedy, etc. Now, the question is: Will the streamers have the same desire to fully distribute their platforms by harnessing sports rights in a similar manner?

It seems inevitable:

Prime Video and Netflix each now reach more homes than cable (nearly as many as broadcast TV).

Each major sports league (except so far the NBA) has an exclusive streaming package, and the major soccer properties including MLS, Premier League, La Liga, Serie A, UEFA and Bundesliga are primarily distributed via streaming.

Apple, Disney (including Hulu and ESPN+), Paramount+ and Peacock all now also carry major live sports.

Amazon, Apple and Google each have market caps that dwarf all traditional media companies combined, against whom they can bid for future, more expansive sports rights.

In particular, Amazon is a frightening disrupter because unlike traditional media companies:

It knows not only how many of its subscribers watched each NFL game, but also exactly who they are, and where they live!

Also, how many minutes they watched, when they logged on and off, the streaming device they used, and if they were on a mobile or wired network, watching via Prime Video or its sister service Twitch. (It achieved 15 million viewers on Sept. 15 despite being a product tilted to big screen viewing; advances in its mobile app will only fuel more viewing on phones.)

Amazon knows what other programming that home also watches, and what music they like.

It knows what actual products that home buys, and what they spend each year on e-commerce.

Amazon also has their email, phone and credit card numbers; Alexa even recognizes their voices!

As a result of this Amazon revolution, sports fans who were once largely anonymous — with no direct relationship with the broadcaster, league or team — are suddenly, continuously and personally connected.

In fact, Amazon represents a new world order — it has a triple revenue stream: Amazon Prime subscriptions, advertising and its viewers’ e-commerce purchases. In addition to AppleTV+/Music/News subscriptions and its own burgeoning ad business, Apple also has a third stream: hardware (iPhones, iPads and Macs). With the three revenue sources, immense cash reserves and global scale, Amazon and Apple can choose to investment spend on anything they wish, elbowing out traditional media competitors, provided they believe it can ultimately benefit their core business.

Having crossed the Rubicon, what’s next?

In terms of game coverage, we see an end to delaying the start and/or joining a game in progress. Every game will be shown in full, complete with the pre/postgame shows. If a game runs long, you can watch it, or the next game (live or delayed), or even watch both simultaneously.

We also foresee the demise of the standalone broadcast. Amazon is complementing its Michaels/Herbstreit main broadcast with other feeds including from Dude Perfect and LeBron James’ The Shop; that’s just the start. Apple will stream MLS games worldwide; and sports now has an instant global backstop service option.

From a business perspective, dated exclusivity grants will be re-examined by rights holders looking to supplement linear reach to target different demographics via non-traditional platforms.

For the fans watching, there will be more variability, customization and creativity. That’s all to the good. But, all of that will come at a steeper price with more service subscriptions and increased fragmentation. After all, crossing the Rubicon is one-way only, and not toll-free!

Ed Desser is president of Desser Media Inc. (www.desser.tv). John Kosner is president of Kosner Media (www.kosnermedia.com). Together they developed league strategy and ran the NBA’s media operations in the ’80s and ’90s.

John Kosner Discussed The Future of Sports Media with Warren Tredrea and Andrew Montesi for The Big Deal Podcast

Original Article: The Big Deal Podcast, November 9th, 2022

In this fascinating interview, John talks about:

Pioneering broadcasting as Michael Jordan transformed the NBA

Building and growing ESPN’s online sports platform

Lessons learned from sports business icon David Stern

The evolution of media rights, and what it means for rights holders, sports organizations and fans

The biggest investment opportunities in sports

Challenges facing the sports industry and a looming ‘reset’

What it takes to build a successful career in the industry

And much more. Listen below or on Apple Podcasts, Spotify and Google Podcasts.

Michael Smith discusses John Kosner's work on the value of NCAA media rights in the Sports Business Journal

Original Article: Sports Business Journal, by Michael Smith, October 31st, 2022

College Basketball: The Times, They Are A-Changin’

The face of college basketball is changing.

Two of the game’s winningest coaches and greatest ambassadors, Mike Krzyzewski and Jay Wright, have retired and no longer will be marching up and down the sidelines. College basketball’s most familiar voice during March Madness, CBS Sports’ Jim Nantz, will say goodbye after the 2023 Final Four.

GETTY IMAGES

Some of the best teams in the nation, like preseason No. 1 North Carolina, will be led by veteran returning players who are juniors and seniors, not the talented one-and-done passers-through who use college basketball as a way station before matriculating to the pros. And schedules are being assembled to accommodate the shifting conference alliances that so often are dictated by the strength of football.

And change isn’t just happening between the white lines. It’s happening off the court and in NCAA meeting rooms in Indianapolis as college leaders contemplate the future of March Madness, the composition of Division I, the expansion of the men’s and women’s basketball tournaments, a new media rights deal for the women’s basketball tournament and new offseason playing opportunities.

All of these transitions are intended to make the game more equitable, appealing and sustainable to the players, the fans and the stakeholders that rely so heavily on its success, while also keeping pace with so many of the shifts in the college landscape — from name, image and likeness to massive player movement through the transfer portal.

“Our business is like that now — everything is a balancing act,” said Dan Gavitt, NCAA senior vice president of basketball. “We have to start thinking about things a little differently. We’re all trying to develop new fan bases, younger fan bases, and engage with fans in different ways. To do that, you have to step out of your comfort zone sometimes, try new things or take events to new places.”

Gavitt will play an instrumental role in many of the college basketball decisions across the horizon. New men’s Final Four sites will be selected next month for 2027-31. A summer series of basketball exhibitions, starting as soon as August, could help college basketball reach a broader audience and provide its players with new NIL opportunities.

Other shifts in the landscape, such as the make-up of Division I and modified championship brackets, will be driven by the NCAA’s Transformation Committee and the Division I Council.

“There’s probably not a lot different that’s above the water this year that a fan would notice,” Big East Commissioner Val Ackerman said of the primary issues in college basketball. “Most of the rules are the same; the tournament format is the same. But there is a lot going on just beneath the surface of the water that administrators and coaches are paying a lot of attention to.”

With that as the backdrop, what follows is a deeper dive into the biggest issues and storylines facing men’s and women’s college basketball, ranging from tournament expansion to media rights and possibly some new innovations that might generate new revenue, as the season tips off this week.

Demonstrating the shift from one-and-done for the top players in college basketball, North Carolina stars Caleb Love (left), R.J. Davis, Leaky Black and Armando Bacot are back this season to lead the preseason No. 1-ranked Tar Heels.

AP IMAGES

NCAA BRACKET MADNESS

Does tournament expansion bring enough financial benefits to merit the growth?

Expanding the NCAA men’s basketball tournament from 68 to 75, 96 or even 128 teams is a discussion worth having, but nothing formal has emerged out of the governing body. Commissioners Jim Phillips from the ACC and Greg Sankey from the SEC have floated the benefits of growing the tournament by 28 or so games — theoretically creating more opportunities for teams that ordinarily would be living on the bubble.

The coaches are becoming more vocal as well. Baylor’s Scott Drew and Missouri’s Dennis Gates advocated for tournament fields of 128 teams last week. The thinking is that there are 363 teams in Division I and a 128-team field would put 35% of the teams into the championship. Other informal proposals have recommended 25% of the teams should make the postseason. In Division I basketball, that would equate to 90 teams in the tournament.

Former Duke coaching legend Mike Krzyzewski will be missing from the Blue Devils’ sidelines, and March Madness, for the first time in more than 40 years.

COURTESY OF DUKE UNIVERSITY

What does that bracket look like? Would CBS Sports and Turner agree to that? Are there any provisions in the NCAA’s media rights contract for additional revenue for an expanded tournament?

Sources indicate that more games would not guarantee more media revenue.

That has prompted a range of reactions about March Madness, most notably that it shouldn’t be fixed if it’s not broken.

It's understandable that those who direct the Power Six leagues (the Power Five plus the Big East in basketball) would push for a larger bracket, the thinking goes. Most of those teams that are on the bubble come from those larger conferences and more at-large bids would most likely increase the chances for teams in the P6 to make the tournament.

There are multiple scenarios that would accomplish the goal of expansion. Going to 96 or 128 teams, while somewhat watering down the product, provides opportunities for conference champions to retain their status as automatic qualifiers while also providing more spots for at-large teams.

Another scenario involves growing the tournament field just slightly — to 75 teams or so — and creating more of the play-in games. That raises the question of whether teams mired in perpetual play-in games are actually part of the tournament or not, and it scares the schools in the smaller conferences because they worry that their automatic bids might be in jeopardy.

For a commissioner like the Big West’s Dan Butterly, access is everything. So, when NCAA committees start talking about taking away automatic qualifier spots for conference champions — no matter the sport — he gets nervous.

“Automatic qualifier spots represent opportunities,” Butterly said. “That would have a pretty big impact on every conference that’s not a high-resource conference. Fortunately, what I’m hearing is that the transformation committee is doing everything they can to protect the automatic bids [for the conference champions].”

Both retired Villanova coach Jay Wright and Jim Nantz of CBS will no longer be a part of March Madness after Nantz calls his last Final Four in 2023.

GETTY IMAGES

BEEN DOWN THIS PATH BEFORE

More games doesn’t guarantee more tournament revenue.

There was a time in 2010 when the NCAA proposed expanding the men’s basketball tournament field to 96 teams. There was an expectation that the media rights would grow exponentially, creating a windfall of new revenue for the governing body and its members.

The response from the networks who saw the presentation never matched up with the NCAA’s expectations. It turned out that there just wasn’t much interest in paying more for a handful of games that pit mediocre teams against one another, even if they played under the March Madness banner.

“The money just isn’t there to make the leap to 96,” Ohio State Athletic Director Gene Smith said when he chaired the basketball committee at the time. “A lot of us assumed more inventory would mean more money, but that just wasn’t the case.”

That’s one reason many college basketball stakeholders don’t expect the men’s tournament to grow to 96 teams in this next iteration of the championship. Ultimately, though, the revenue will have to match up with the larger field.

“The NCAA’s championships really have not been right-sized for a long time,” West Coast Conference Commissioner Gloria Nevarez said. “We haven’t taken a lens to the championships unless it was for cost savings or cost cutting. How are we traveling teams? How do we seed in regionalized brackets? It’s not just what we can afford to do, but if we’re going to be transformational, let’s look at what should these championships look like.”

The men’s and women’s NCAA tournament fields have had 68 teams for years, but there is steady talk about adding schools.

GETTY IMAGES

UNBUNDLING MEDIA RIGHTS

Could separate negotiations help women’s basketball break out?

The NCAA is considering an unbundled approach when it takes its championship events to the media marketplace, which would enable the governing body to sell media rights to the women’s basketball tournament separately. That’s a significant change to the way the NCAA has negotiated in the past.

“We are very seriously considering breaking up the package and exploring whether there’s greater value in selling the championships individually rather than as a bundled package,” Gavitt said. “Time will tell, but that’s the work we’re doing now — how best to position those rights to take them to the market.”

One stop, then another.

In this new era of player movement, athletes are bouncing from one school to the next. A look at stats related to men’s and women’s basketball player transfers in Division I in 2021.

Source: NCAA Get the data Created with Datawrapper

The current media rights agreement with ESPN for all Division I championships, except men’s basketball, pays the NCAA about $40 million annually. The way the deal is structured, though, has been the source of considerable debate, especially the past two years. For as long as the NCAA has taken these championships to the marketplace, it has sold them as a package, believing that a bundled set of rights was the most efficient way to sell them. There is growing skepticism about that now.

As more fans began showing up for the women’s Final Four and watching the games on TV, the growing popularity of the women’s basketball tournament became more evident. What finally shed some light on the championship was the 2021 event in San Antonio, where Oregon’s Sedona Prince shot a video of the meager workout facilities at the team hotel, compared to what the men had in Indianapolis. That led to the Kaplan Report, which evaluated the media arrangement as part of its analysis.

The NCAA was leaving millions of dollars on the table by going to the marketplace with all of those championship rights bundled, Ed Desser and John Kosner wrote in the report.

ESPN’s media rights contract runs through August 2024. The network and the NCAA will begin negotiations about this time next year. The NCAA’s Gavitt and Lynn Holzman — vice president of women’s basketball — will take the lead for the governing body, supported by media consultants who have not yet been hired.

Endeavor’s Karen Brodkin and IMG’s Hillary Mandel have done some analytical work for the NCAA in the past. Separately, consultants Desser and Kosner wrote the analysis for the Kaplan Report.

Ackerman: “We’re closing in on the time to make these decisions. Sometime next year, the NCAA is going to have to figure out what sports it’s going to take to the market separately versus bundled."

“There are tremendous opportunities if we unbundle,” Nevarez said.

An unbundled approach would enable the NCAA to take some of its most valued championships, such as baseball and softball, ice hockey and volleyball to the marketplace individually.

The potential drawback would be whether there’s enough competition for those media rights to truly drive the prices higher. Whether the championships are bundled or unbundled, the media rights’ value might be dictated by a lack of interest beyond the walls of ESPN.

Butterly: “It would be a positive step” to unbundle the rights. “You see the growth of women's basketball and women's sports overall. I mean the emphasis being placed in that area. … I think that would be a positive to be able to separate it and allow it to be a standalone event, so you’d really provide that opportunity for continued growth at the event.”

INNOVATIONS FOR THE FUTURE

Changes could provide new opportunities, fresh ideas as college basketball adjusts and adapts.

Summertime basketball, midseason conference tournaments, conference all-star games, revenue units from the women’s basketball tournament. These new or developing concepts along with name, image and likeness, the transfer portal and tournament expansion, could give college basketball a much-needed refresh in the next few years in an overall landscape driven more than ever by college football.

South Carolina women’s basketball coach Dawn Staley, whose team won the 2022 national championship, is interviewed by SEC Network sideline reporter Steffi Sorensen in March at the SEC tournament.

GETTY IMAGES

None of the ideas are slam dunks, though, and most would require an unprecedented level of cooperation among schools, conferences and media partners.

But concepts like a midseason all-star game, out-of-season contests between conference foes who are not scheduled to play one another in a given season, and summertime basketball certainly sound like further “professionalism of the college game,” said Brooks Downing, whose agency, BDG Sports, runs basketball events throughout the season.

There’s an NIL factor involved in these schedule modifications and neutral-site games as well. In the past, event promoters would pay a fee plus expenses to secure teams in their events. Now, sources say, schools are demanding that payments go to the NIL collectives that funnel the money to the players as NIL income.

It’s the end of an era and the beginning of a new one. The game is changing on a variety of levels and it could look different in the next few years.

Ackerman: “Innovation is all around us, especially if you look at what the pro leagues are doing. So, I think the challenge for college sports leaders is to keep a good thing going, but also how to keep it from backsliding or getting stuck.”

"How To Be a Great Sports Media Partner," John Kosner's latest SBJ column with Ed Desser

Original Article: Sports Business Journal, by Ed Desser and John Kosner, October 17th, 2022

The Seven Habits of Highly Effective Media Partners

Recently, we wrote how the unique NBA on NBC partnership changed our industry and elevated the NBA (Sports Business Journal, Sept. 19, 2022). The friendship of visionary leaders Dick Ebersol and David Stern galvanized both organizations. But you don’t have to be an industry icon to become an excellent media partner. It is a way of thinking about relationships, creating value for all. Here are seven pointers we’ve picked up from our experiences at the NBA and after:

The answer is “Yes!” The best way to build mutually beneficial relationships is to view the success of your partner as your success. Make your default to figure things out, which frequently will be contagious. When Bob Iger was CEO at Disney, he spoke often about the importance of optimism — bring that to your relationships!

Over-deliver: Doing more than what is expected makes an impression. When CBS broadcast the NBA, it used three to four replay devices. Moving to NBC, we wanted four or five. NBC made eight replay units standard, even for regular-season games. We did not have to ask. That approach pushes the other partner to go above and beyond too.

Anticipate needs: What’s better than getting “Yes!” for an answer? Again, never needing to ask. For example, we knew which NBA arenas had poor lighting and/or camera locations. We took those challenges on ourselves, before partners complained. That spirit continues today as the NBA initiates technical enhancements that provide future solutions for the league’s global broadcasters.

Know your partner’s business (better than they do): That was quintessential David Stern — not satisfied with the NBA being experts of (only) our domain. Hyperbole? Sure! But the emphasis is right. We knew how important the Olympics were to NBC. That drove urgency in the formation and marketing of the 1992 Olympic Dream Team and all that followed. Did that success extend to the NBA? Of course, but that’s the point of effective teamwork. The NBA was similarly instrumental to Turner, agreeing to switch from TBS to TNT once the latter reached 30 million subscribers (achieved in record time) — a possible streamer’s tactic today.

More partnership examples from other sports:

When it renewed its deal with Fox in 2020, the NHRA knew the network had to hold multiple fall Sundays open for NFL doubleheaders, even though the NFL would only schedule single Fox windows on half of those dates. By planning a series of “playoff” races on several straight fall weekends, NHRA could guarantee Fox an event on at least one of those “singleheader” Sundays. On Sept. 18, following its NFL game, the NHRA on Fox drew 1.7 million viewers, its most-watched race ever.

In 2010, ESPN and MLB’s digital arm BAM were spirited competitors although ESPN was (and is) a longtime MLB rights holder. At ESPN, we knew the quality of BAM’s streaming infrastructure and discussions revealed an opportunity: BAM was built for the baseball season, while our streaming needs were focused on college football and basketball. The result: BAM became a valuable “white label” solution for ESPN, setting the stage for Disney’s eventual purchase of BAMTech five years ago.

Fox has a lighter event calendar in the spring. The Pro Bowlers Association developed a weekly “PBA Playoffs” series after college basketball ends, providing weekly content for Fox and an additional programming series for the PBA.

Forge true partnerships: In 1990, the NBA had a lot to prove when NBC scheduled a huge increase in games from the handful CBS had broadcast. To deliver the highest possible audience (and ad sales), we needed a great schedule. NBA scheduling savant Matt Winick and Ebersol worked together each summer to craft key matchups to maximize audience. In fact, Dick sat backstage during the NBA Draft (which NBC wasn’t even carrying). An emphasis on similar “win-win” teamwork yielded a revenue-sharing approach, which strengthened NBC’s and Turner’s advertising businesses and ultimately paid the NBA hundreds of millions extra from sales growth. And in 1997, the partners combined to launch the WNBA, which just completed its 26th season!

The same partnership logic applies to smaller properties. The National Finals Rodeo in Las Vegas is the sport’s Super Bowl. In 2020, the Professional Rodeo Cowboys Association moved its full-season linear TV events package to Rural Media Group’s RFD-TV/Cowboy Channel, securing added rights fees and a more comprehensive broadcast schedule. Rather than selling its direct-to-consumer product in a lucrative streaming deal to a third party, the PRCA doubled down, co-developing The Cowboy Channel Plus, a rodeo-oriented DTC product with its partner RMG.

Think big: Extraordinary relationships can deliver unheard-of innovation. Together, the NBA and NBC developed “NBA Inside Stuff,” a weekly tween-targeted show about league personalities. We still hear from young fans who grew up watching it.

Finally, over-communicate! Schedule regular get-togethers. Plan a preseason summit meeting for executives from each company. Do a postseason debrief. Develop social relationships at your events. This fosters goodwill and leads to true successes, while minimizing the risk of the worst-case scenario: surprising your partner with bad news. And when you are dealing with bad news, remember, delivering that news quickly can actually be a gift — especially if the partners address the problem together. That’s the value of a trusted relationship.

Considering today’s myriad challenges and ever-increasing marketplace complications, being a good media partner is even more important. It’s a state of mind, and a way to get noticed!

Ed Desser is an industry expert witness and president of Desser Media Inc. (www.desser.tv). John Kosner is president of Kosner Media (www.kosnermedia.com). Together they developed league strategy and ran the NBA’s media operations in the ’80s and ’90s.

John Kosner Spoke with Mike McCarthy of Front Office Sports about the NBA’s Next Media Rights Deal

Original Article: Front Office Sports, by Michael McCarthy, October 15th, 2022

Hi, this is Mike McCarthy, Senior Writer at Front Office Sports! Sports media just reached an inflection point.

In the span of a few weeks, Amazon Prime Video took over exclusive coverage of the NFL’s “Thursday Night Football” and Apple TV+ streamed a historic New York Yankees game. And guess what? Despite a few hiccups, the sky didn’t fall. Most viewers adjusted. That brings us to the NBA, which tips off Tuesday.

The league will shortly begin talks for its next billion-dollar set of media rights. The closely watched negotiations will likely pit linear incumbents ESPN and TNT against streaming giants Amazon and Apple in a bidding war.

Let’s dive in. You can find me after on Twitter.

Would The NBA Embrace Streaming for $100B?

Darren Yamashita-USA TODAY Sports

Twenty years ago, the National Basketball Association transformed the sports media landscape by moving most of its games from free over-the-air television to pay cable networks.

The question now is whether the league will spark another seismic shift by embracing the brave new world of streaming TV.

The NBA’s expected to seek upward of $75 billion for its next media rights package starting in 2025. It boasts rising superstars like Ja Morant and Jayson Tatum, a tech-savvy audience, and global appeal.

On the other hand, its cable-heavy distribution model is under heavy pressure from cord-cutters in the U.S. as younger consumers shift to streaming services.

Under current deals that run through the 2024-25 season, Disney’s ABC/ESPN and Warner Bros. Discovery’s TNT are paying a combined $24 billion, or $2.6 billion annually.

As the new season tips off in San Francisco and Boston on Tuesday night, the league’s media strategies could be coming full circle.

Back in January 2002, ESPN was the insurgent that sold the NBA on moving mostly to cable from broadcast — ending the 12-year run of the popular “NBA on NBC,” which brought us Michael Jordan’s dynastic Chicago Bulls, Bob Costas, and John Tesh’s “Roundball Rock” theme song.

Now the tables have turned. It’s ESPN and TNT, and their legacy media parents, that will have to play defense against Amazon and Apple, as well as possible contenders like Google.

And don’t count out sports betting giants like FanDuel and DraftKings, that want to create a “watch and bet” environment that includes in-game wagering.

The Tradeoff

Despite their bottomless pockets, the tech giants will have to prove that the NBA won’t lose most of its audience by moving a large percentage of its national games to streaming.

If you think the bidding was lucrative two decades ago, you ain’t seen nothing yet.

“I would say that all of the leading technology companies are interested in the NBA. Amazon is just one of them. I think Apple, I think Google. All of them,” said John Kosner, former NBA and ESPN executive turned media advisor and the founder of Kosner Media.

“And keep in mind the definition of what’s a ‘rights package’ going forward doesn’t have to be what we grew up with,” he added. “A company like Discord (a social platform with 150 million monthly users) could become an NBA rights holder at some point, too. I think they’re all interested.”

This season, Disney will air 82 games on ESPN and 18 on ABC, as well as the NBA Playoffs and NBA Finals.

ESPN boss Jimmy Pitaro has made it clear he wants to stay in business with the league.

“It’s an incredibly important property for us. We also see that property as ascending — younger demographics. Right now, I think they have more parity than we’ve seen in a long time,” Pitaro told The Athletic. “We see young stars who are starting to catch on in the zeitgeist. We are incredibly excited about the NBA.”

NBA Game-Changer

The stakes are high for the $10 billion league as it tips off its 76th season.

The NBA’s pioneering embrace of cable TV two decades ago sparked a migration of sports properties from traditional networks.

The NFL’s first primetime showcase, “Monday Night Football,” shifted to ESPN from ABC in 2006.

A year later, Major League Baseball’s first-round playoff games were shown exclusively on cable TV (TBS) for the first time.

College football’s former Bowl Championship Series moved to ESPN from ABC and Fox Sports in 2011.

The NBA never completely abandoned free TV — ABC has aired the NBA Finals, as well as select weekend matchups, since 2003.

But the ability to pocket higher rights fees from cable operators was the primary reason why sports leagues like the NBA and MLB moved the bulk of their games to cable.

ESPN offered a dual revenue stream from both advertisers and subscribers. Broadcasters like NBC (reliant only on ad revenue) couldn’t compete.

NBC’s Dick Ebersol lamented at the time, ”In the future it will become almost impossible for broadcast television sports to match the power of those subscriber fees.”

History Repeats?

Cord-cutting has significantly slashed the footprint of pay cable operators. During fiscal year 2021, for example, ESPN’s distribution shrank 10% to 76 million U.S. homes — a 24% drop from a high of 100 million a decade ago.

Cash-rich Amazon and Apple are expanding into live sports with each boasting market capitalizations of over $1 trillion.

Amazon is paying the NFL $1 billion a year to serve as the exclusive carrier of “Thursday Night Football” through 2033.

The deal marks the first time the NFL sold an exclusive national rights package to a digital streaming service.

“TNF” previously aired across a “tri-cast” of Fox Sports, NFL Network, and Amazon.

Separately, Amazon Prime also scored a package of 21 New York Yankees games in the team’s home TV market.

Meanwhile, Apple signed a $2.5 billion, 10-year deal to exclusively show all Major League Soccer matches — and is slowly moving into baseball, too.

Starting in 2023, Apple’s streaming service will take over all local and national MLS games currently carried by ESPN, Fox, Twitter, and regional sports networks.

In March, Apple and Major League Baseball agreed to a streaming deal that pays the league an estimated $85 million a year for a package of “Friday Night Baseball” games.

In its first season streaming MLB, Apple exclusively scored a key New York Yankees game at the height of Aaron Judge’s home run record chase.

Google is said to be pursuing the NFL’s Sunday Ticket package of out-of-market games, along with Apple, Amazon, and Disney.

The league wants the winning bidder to cough up $2.5 billion annually — a big spike from DirecTV’s $1.5 billion. The NBA sees the value of its media rights increasing, too.

Silver Holds the Cards

With Amazon in the mix, the NFL scored its long-term $100 billion-plus media rights payday last year. It’s the NBA’s turn now.

Adam Silver’s NBA is the most tech-forward league, and the savvy commissioner has plenty of options as he looks down the road.

The league could re-up with ESPN and TNT for linear TV while selling an exclusive streaming package.

Or it could roll the dice and embrace a streaming model the way it went mostly cable TV 20 years ago. It’s not implausible — the NBA already has a $1.5 billion per year streaming deal with Tencent Holdings in China.

The Answer Is Always Money

The late, great sports TV producer Don Ohlmeyer used to say, “The answer to all your questions is money.”

It remains to be seen whether a bet on streaming will pay off like the NBA’s gamble on cable.

But given the Association’s history of bold moves, don’t be surprised if the league makes a fast break toward what it sees as the media future of sports, especially if embracing non-traditional platforms gives it a shot at NFL-level media rights revenue — the coveted $100 billion figure.

That could mean doing business with Amazon, Apple, or Google. Either way, these negotiations won’t be a lay-up for ESPN and TNT.

Look for a bidding war that will go right down to the buzzer.

Original Article: Front Office Sports, by Michael McCarthy, October 10th, 2022

Amazon is off to a strong start with the NFL’s “Thursday Night Football.” Given its early success, the e-commerce giant is making the case that it can take on the next mega sports rights package: the NBA.

The NBA’s current U.S. media deals with Disney’s ESPN/ABC and Warner Bros. Discovery’s TNT expire after the 2024-25 season.

The league will likely seek $50 billion to $75 billion for its next multi-year package, said sources. Amazon is paying the NFL around $1 billion a year to exclusively stream TNF through 2033.

Amazon has long been cited as a potential NBA bidder. But every week it defies expectations with TNF, that theory becomes more of a reality.

“The (NBA) has certainly done very well for a long time with ESPN and Turner. But interest in the league — and its strategic importance — are only growing,” said John Kosner, the former NBA and ESPN executive turned investor and advisor.

Commissioner Adam Silver’s NBA is the most technology-forward sports league. Amazon believes TNF’s better-than-anticipated performance — and built-in audience of over 200 million Amazon Prime customers — makes it attractive to the global NBA, said sources.

By Nielsen data, TNF is averaging 11.3 million viewers — up 11% from the first four games last year across NFL Network and a tri-cast of Fox Sports, NFLN, and Amazon.

By its own metrics, Amazon Prime Video is averaging 13.3 million viewers for TNF through four games.

Amazon is proving it can draw a harder-to-reach audience: TNF viewers are eight years younger (46 years old) than those on TV networks.

TNF is averaging 2.7 million viewers in the advertiser-coveted 18-34 demographic, up 67% from last year.

The NBA has already embraced streaming in China. The league boasts a $1.5 billion-a-year deal with Tencent Holdings that enables it to reach over 500 million basketball fans in China.

Similar to the U.S., that rights deal runs through the 2024-25 season.

Big Tech vs. Legacy Media

The NBA surpassed $10 billion in revenue for the first time with the 2021-2022 season. Jeff Bezos’ Amazon won’t get the NBA without a fight. ESPN and TNT will battle to retain their packages, said sources.

The two companies will pay the NBA a combined $24 billion under the current nine-year deal, which kicked in during the 2016-17 season.

It’s still to be determined how the NBA will split up the next rights package. Sports betting giants will also be looking to carve off a piece of NBA media rights to create a “watch and bet” environment, said sources.

With a bidding war looming between tech and TV competitors, the NBA’s almost certain to double its current rights fees to at least $50 billion, said sources.

That would jack up its annual media payout to the $5 billion range from the current $2.6 billion. ESPN pays $1.4 billion vs. TNT’s $1.2 billion (ESPN’s sister Disney network ABC gets exclusive rights to the NBA Finals).

But the bidding could go even higher. CNBC previously reported the NBA could seek $75 billion for its next rights package. Amazon and the NBA declined to comment.

The NBA On NBC Partnership: The Relationship changed sports media and crowned the NBA," John Kosner's latest SBJ column with Ed Desser

Original Article: Sports Business Journal, by John Kosner and Ed Desser, September 19th, 2022

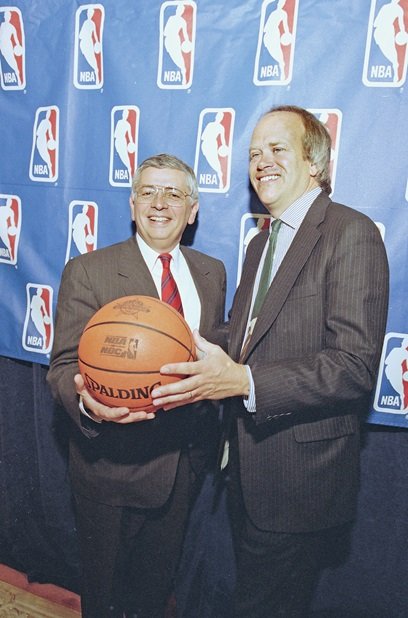

NBA Commissioner David Stern and NBC’s Dick Ebersol worked together to greatly expand the league’s coverage.

AP IMAGES

“A spectacular move!” Sports fans know the clip — Michael Jordan switching hands in mid-air to score; the call from the legendary Marv Albert. But we’re writing about another, similarly spectacular move made by the and NBC on Nov. 9, 1989:

NBC stunned the industry 33 years ago by paying the NBA $600 million-plus, more than triple what the incumbent had been paying, putting the NBA on the map, cementing the visionary reputations of NBA Commissioner David Stern and NBC Sports President Dick Ebersol as sports impresarios, and birthing a truly unique league/network “marriage” that netted (pun intended) a massive “win-win.” It represented a pivotal moment in our careers, and reordered sports media, transforming the NBA.

First, the context: Ed joined the NBA in 1982 as its director of broadcasting/executive producer; John started out as programming assistant at CBS Sports. That season, CBS scheduled only five regular-season NBA games — each involving the Lakers, Celtics and 76ers. Until 1982, weeknight NBA Finals were on CBS late-night tape-delay, so concerned was CBS not to air NBA games in prime time during the crucial “May Sweeps.” The NBA was a programming stepchild. “Our fans like us,” Stern once mused to John, “but they don’t like themselves for liking us!”

The NBA began to rally in its final years with CBS, as Ted Shaker took over as executive producer, adding innovations like “At the Half with Pat O’Brien” and slicker productions that highlighted the many emerging NBA superstars, like Jordan. Just after 6 p.m. ET on Sunday, May 7, 1989, Jordan electrified the nation, hitting the hanging, series-deciding, buzzer-beater over the Cavs’ Craig Ehlo in the opening round of the playoffs. We took note.

We were now working together at the NBA. CBS itself shocked the industry (and us) by paying $1.1 billion to take away NBC’s 41-year national TV “birthright,” providing NBC with airtime and motivation, and us an opportunity.